Market Insights:

January 2, 2024

Posted on January 02, 2024

Planning and Guidance, Tailored To Your Life and Goals

Tuesday Takeaway

Posted on February 23, 2016

“Squawking pessimism can’t drown out what is a very respectable start to 2016. Economic data so far this year, apart from predictions of deflation and negative interest rates, could justify what was scheduled to be, but what soon seemed impossible, a rate hike at the March FOMC. Yes, global factors are a risk and are hurting the factory sector but service prices are definitely on the climb and vehicle prices and vehicle production, reflecting strength in domestic demand, are back up. Ignore the cacophony of doubt and look at the economic data for yourself!”

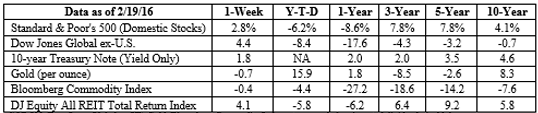

U.S. economic data was generally positive last week, but that wasn’t the primary driver behind the rally in U.S. stock markets, according to Reuters. Nope, that had more to do with oil prices. Despite serious political differences, Iran and Saudi Arabia appeared to reach an accord on oil production last week, when Iran endorsed a plan by Saudi Arabia to stabilize global oil prices, according to The Guardian. The agreement pushed oil prices higher mid-week. However, late in the week, news that oil stockpiles in the U.S. were at record levels reignited worries about oversupply and oil prices fell at week’s end. U.S. stock markets followed, giving back some of the week’s gains on Friday, but all of the major indices finished more than 2 percent higher for the week. Economic data may dominate the news next week. We’ll get more information on housing, durable goods orders, jobless claims for February, and a revised estimate for fourth quarter’s gross domestic product growth. Barron’s suggested a strong employment report in tandem with rising prices could influence the Fed’s interest rate decision.

]]>

]]>