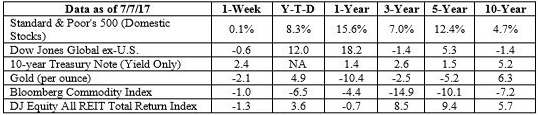

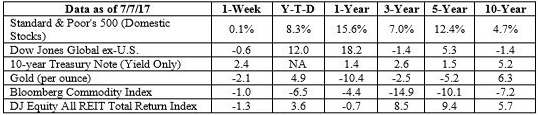

The bond market bear watch. The yield on 10-year German Bunds (Germany’s government bonds) reached an 18-month high of 0.58 percent recently. Yields rose after the European Central Bank’s Mario Draghi indicated its stimulus efforts would end at some point.

When bond yields rise, bond values fall, and that makes rising interest rates quite a significant event for anyone who holds lower yielding bonds. In the United States, 10-year U.S. Treasuries moved to a seven-week high last week and then dipped lower following the release of the Federal Open Market Committee meeting minutes, reported CNBC.com.

Financial companies gaining favor. During the past month, U.S. stock markets have seen a sector rotation. FT reported:

| “…S&P financials have gained some 6 percent, with tech sliding almost 4 percent. That still leaves financials lagging behind the S&P 500 for the year and well behind the roughly 17 percent gain for tech. A similar story has unfolded in Europe between banks and tech.” |

Investors’ appetite for financial companies may reflect the belief higher interest rates are ahead. Banks and other financial firms generally benefit when interest rates rise. Investor’s Business Daily reported:

| “Several Wall Street giants have warned of weak trading revenue in Q2, continuing the lackluster trend in 2017…Still, bank stocks large and small have been leading in recent weeks, helped by higher bond yields and massive buyback and dividend plans.” |

Last week, the unemployment rate in the United States rose from 4.3 to 4.4 percent. It was good news according to an expert cited by Barron’s, “…the rise in labor force participation indicates slack remains in the labor market.” That may be the reason wages showed little improvement.

It Doesn’t Appear To Be Common Knowledge But…

There may be an affordable car crisis in the United States. The latest

Bankrate.com Car Affordability Study found:

| “…typical households in most of America’s larger cities don’t earn enough to afford the average new vehicle, under a common budgeting rule for buyers… The ‘20/4/10’ rule says you should aim to put down at least 20 percent of a vehicle’s purchase price, take out a car loan for no longer than four years, and devote no more than 10 percent of your annual income to car payments, interest, and insurance. If you can’t stay within those lines, you can’t afford the car.” |

The only major city where a new car remains affordable is Washington, D.C.!

For some, the obvious solution is choosing a less expensive model. For others, the answer is buying a used vehicle. For the latter group, here’s some bad news: even an average-priced used car – nationally, the average price is about $19,200 – is unaffordable for households in eight of the 25 largest cities.

Leasing is also an option; one that may have helped create an oversupply of used cars. In July, Automotive News reported:

| “…millions [of] cars that were leased two or three years ago, many of them used compact and midsized cars with low mileage, are heading toward auction lots and used car dealerships. That surge in supply threatens to depress prices for new and used vehicles, raising the risk of losses for automakers and finance companies on lease deals. It also undercuts the value of cars customers want to trade in for a new vehicle.” |

The rising popularity of ride-sharing and car-sharing, and the introduction of self-driving vehicles, may also depress prices. In fact, some automakers have introduced their own ride-sharing services.]]>