Market Insights:

January 2, 2024

Posted on January 02, 2024

Planning and Guidance, Tailored To Your Life and Goals

Tuesday Takeaway

Posted on April 02, 2019

The Markets

“Fascinatingly counterintuitive…”

That’s how Michael Arone, an investment strategist, described the U.S. market environment to Avi Salzman of Barron’s:

“‘Stocks are rallying, but bond yields are reflecting much lower growth.’ Stocks rose during the quarter because the Fed backed away from raising interest rates, and investors grew more confident that the U.S. and China would sign a trade deal, Arone said. The market was also rebounding from a very rough fourth quarter – ‘conditions at the end of the year were wildly oversold,’ he noted.”

Through the end of last week, the Standard & Poor’s 500 Index was up more than 13 percent year-to-date, despite falling corporate earnings and modest consumer spending gains.

Consumer optimism may have played a role in U.S. stock market gains. The University of Michigan’s Surveys of Consumers Economist Richard Curtin reported:

“…the last time a larger proportion of households reported income gains was in 1966. Rising incomes were accompanied by lower expected year-ahead inflation rates, resulting in more favorable real income expectations…Moreover, all income groups voiced more favorable growth prospects for the overall economy…Overall, the data do not indicate an emerging recession but point toward slightly lower unit sales of vehicles and homes during the year ahead.”

The Bureau of Economic Analysis released its report on economic growth in 2018 last week. Real gross domestic product (GDP), which is a measure of economic growth after inflation, was revised down to 2.2 percent in the fourth quarter of 2018. Growth was up 2.9 percent for the year, though, which was an improvement on 2017’s gain of 2.2 percent.

Slowing economic growth gives weight to bond investors’ expectations, while consumer optimism supports stock investors’ outlook. Divergent market performance and conflicting data make it hard to know what may be ahead. One way to protect capital is to hold a well-diversified portfolio.

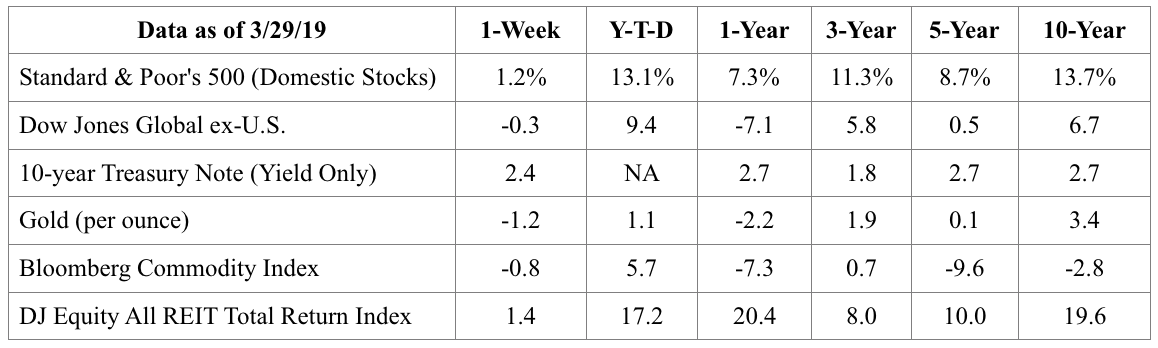

[caption id="attachment_2800" align="alignnone" width="1158"] S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods. Sources: Yahoo! Finance, MarketWatch, djindexes.com, London Bullion Market Association.[/caption]

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods. Sources: Yahoo! Finance, MarketWatch, djindexes.com, London Bullion Market Association.[/caption]

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

You may not have given it much thought, but it costs money to make money. In fact, the costs of the metals required to make some U.S. coins is higher than the value of the coins! George Washington and Abraham Lincoln might not approv, if they knew. Take this quiz to see what you know about the cost and value of U.S. coins.

According to the Federal Reserve, the estimated lifespan of a $10 bill is 4.5 years. The estimated lifespans of a $5 and $1 bill are 5.5 years and 5.8 years, respectively. A $100 bill may last 15.5 years because it circulates less frequently.

Answers: