Market Insights:

January 2, 2024

Posted on January 02, 2024

Planning and Guidance, Tailored To Your Life and Goals

Tuesday Takeaway

Posted on December 01, 2020

Last week, vaccine optimism immunized investors against signs of economic weakness.

In previous commentaries we’ve written about narrative economics, which holds that popular stories may affect individual and collective economic behavior. Last week, diverse narratives had the potential to influence consumer and investor behavior, but not all did. You may have read that:

Coronavirus anxiety is high. “Figures from recent days suggest infections may have fallen off from record highs in some states. But no one is cheering in the emergency wards. Health workers fear that Thanksgiving gatherings will prove to be super-spreader moments… Meanwhile many college students have just gone home for the year… [A medical professional said], ‘It is like slow-motion horror. We’re just standing there and being run over,’” reported The Economist.

Unemployment claims moved higher. “The number of Americans filing first-time claims for jobless benefits increased further last week, suggesting an explosion in new COVID-19 infections and business restrictions were boosting layoffs and undermining the labor market recovery,” reported Lucia Mutikani of Reuters.

Economic stimulus is needed. “As it stands, tens of millions are already struggling to make rent payments and put food on the table. The $1,200 stimulus checks sent out by the government in the spring have long run dry and 12 million Americans are set to lose unemployment insurance the day after Christmas if Congress does not act,” reported Jacqueline Alemany of The Washington Post.

Vaccines are on the way. “As G20 leaders pledged to ensure the equitable distribution of COVID-19 vaccines, drugs, and tests so that poorer countries are not left out, the United States, United Kingdom, and Germany each announced plans to begin vaccinations in their countries in December…,” reported The Guardian.

Fiscal and monetary policy will reinvigorate the economy. “Surely the market strength reflects the fact that barring [vaccine] rollout disasters, we should have our normal lives back within months…Now add in the widely held assumption that the expected new Treasury secretary Janet Yellen will deliver the additional stimulus she has called for, and the newish Federal Reserve rhetoric that holds interest rates need to stay low…Suddenly it makes perfect sense to think that pent up demand and possible productivity gains created by the crisis could help set off what Goldman Sachs calls the Roaring 20s Redux,” wrote Merryn Somerset Webb for Financial Times.

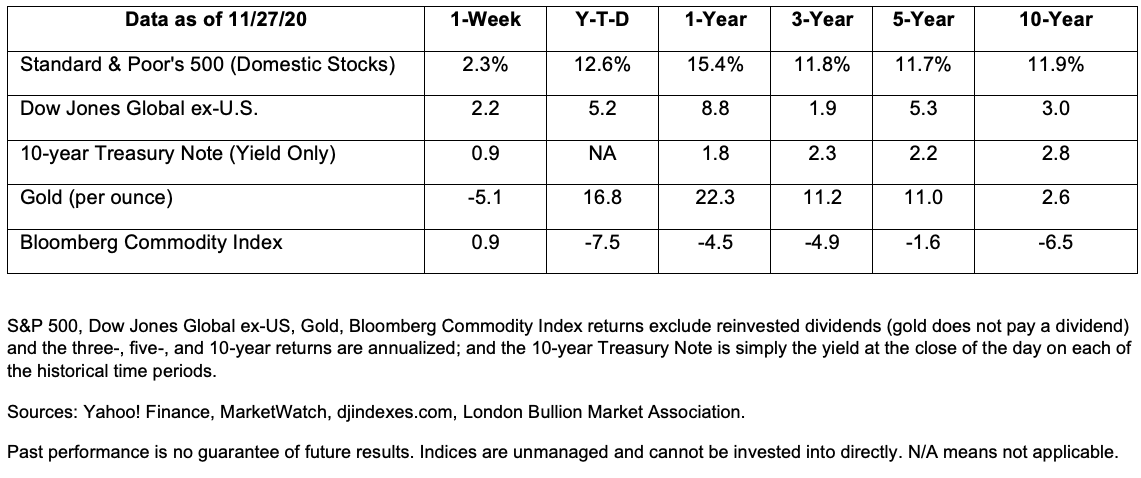

The optimistic stories – the potential for vaccines to restore ‘normal’ and the possibility of new stimulus measures if Janet Yellen becomes Treasury Secretary – helped drive markets higher last week. Global stock markets rose and were positioned to deliver their best monthly performance ever, reported Camilla Hodgson of Financial Times.

In the United States, the Dow Jones Industrial Average moved above 30,000 before retreating, and the Standard & Poor’s 500 and Nasdaq Composite Indices both finished the week at record highs, reported Ben Levisohn of Barron’s.

A lot of that money will be spent online. On Black Friday, U.S. consumers shelled out more than $9 billion online, reported TechCrunch. It was the second biggest day for digital commerce in history. The first was Cyber Monday 2019.

Overall, online holiday sales are expected to break all previous growth records. A report from Adobe estimated 2020 digital sales will be up 20 to 47 percent, year-over-year. That’s a broad range because there is a lot of uncertainty about levels of disposable income and capacity limits for brick-and-mortar stores. The report stated:

“If flu season brings with it a spike in [coronavirus] cases and an increase in store restrictions, a reduced store capacity will drive more people online. E-commerce is still only around one out of every $4 spent on retail. That’s a large bucket of dollars that could move online, leading to potential for big swings this season.”

Whether you are holiday shopping in person or online, or using a smartphone or computer, watching trends may help investors identify new investment opportunities.

Most people are familiar with the Dow, but when it broke 30,000 last week, you wouldn’t be the only person asking what it all means.

The most obvious meaning is that equities are increasing in value, pushing up the Dow and indicating our economy is resilient, even in the midst of an escalating pandemic.

That’s good news. For the average person, their 401(k)s may not be impacted by the Dow’s milestone, but just knowing the Dow’s increase bodes well for our overall economy is positive news… especially after most of us feel as though we’ve struggled to get through 2020.

Bezinga.com reports 17 years passed from the time the Dow was at 10,000 and until it hit 20,000. Reaching 30,000 only took four years. Last week’s milestone has been attributed to good news about a Coronavirus vaccine, an increased possibility of a peaceful presidential transition from Trump to Biden, and the potential appointment of Janet Yellen as Fed Chairwoman.

Read Bezinga’s article here: https://www.benzinga.com/analyst-ratings/analyst-color/20/11/18518537/dow-hits-30-000-but-does-it-mean-anything?utm_source=dlvr.it&utm_medium=facebook).