Market Insights:

January 2, 2024

Posted on January 02, 2024

Planning and Guidance, Tailored To Your Life and Goals

Tuesday Takeaway

Posted on December 29, 2020

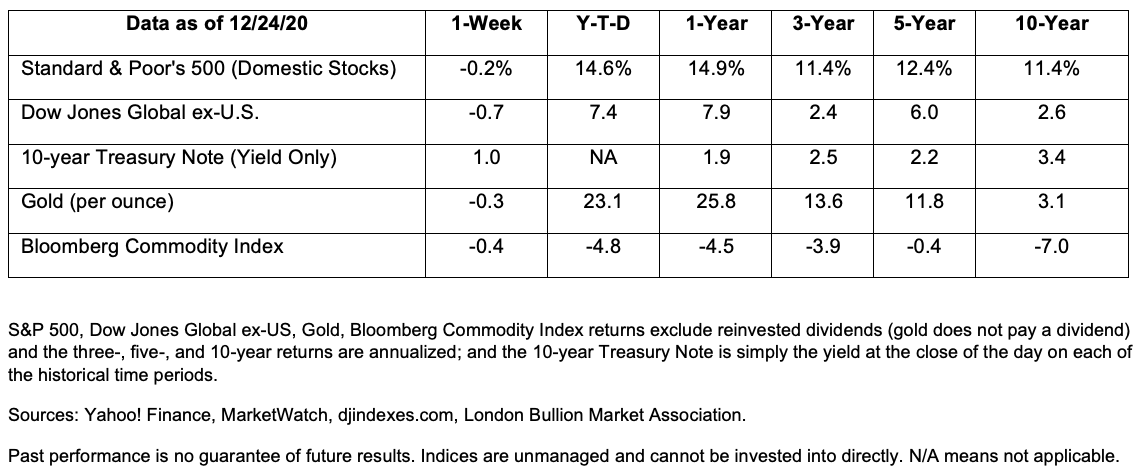

U.S. stock markets remained calm as a fresh chapter opened in the coronavirus stimulus saga last week.

Congress managed to cobble together a new stimulus package that was acceptable to both sides and pass it. The proposed package included money to help states distribute vaccines, an unemployment benefits extension, $600 checks for eligible Americans, aid for airlines, and other provisions, reported Mike Calia of CNBC.

“…fiscal support is seen as critical to keep the economic recovery from faltering as coronavirus cases rise and cities consider new shutdowns. Consumer spending has flagged, and labor market gains have begun to stall. While the number of Americans applying for unemployment benefits declined last week, it still remains elevated compared with pre-COVID levels,” reported Colby Smith and Eric Platt of Financial Times.

President Trump disagreed with some provisions in the bill, reported Financial Times. Over the weekend, it was unclear whether he would sign it, veto it, or just hold it without taking action.

Since the $900 billion stimulus bill was attached to the $1.4 trillion government funding bill, the impact of a veto or inaction could be quite significant. “Without Trump’s signature, the government may partially shut down on Tuesday as funding runs out, though Congress could pass a stopgap measure,” reported Daren Fonda of Barron’s.

Stock investors appeared optimistic President Trump would sign the bill. News of a Brexit trade deal and a more contagious version of the virus in the United Kingdom had limited impact on U.S. markets.

All-in-all it was a quiet holiday week and major U.S. indices finished with mixed results. If the stimulus bill is not signed and a stopgap measure is not passed, markets could be volatile next week.

After a year of living with the fear of COVID-19, many investors are hoping 2021 will bring a return to ‘normal,’ even if the new normal may not be exactly like the old one.

Optimism about the future has many investors feeling bullish, according to most of the sentiment surveys listed in Barron’s last week. Financial Times reported, “Almost universally, fund managers believe the year will bring a rebound in economic activity, supporting assets that have already soared in value since the depths of the pandemic crisis in March, but also lifting sectors that had been left behind. Bond yields are expected to stay low, lending further support to stock valuations.”

This doesn’t mean 2021 will be risk free. In its December market sentiment survey, Deutsche Bank asked more than 900 market professionals about the biggest risks to global financial markets in 2021. Here are the concerns they highlighted:

38 percent Virus mutates and vaccines are less effective

36 percent Vaccine side effects emerge

34 percent People refuse to take the vaccine

34 percent Technology bubble bursts

26 percent Central banks end stimulus too soon

22 percent Inflation returns earlier than expected

It’s possible none of these will occur and investors will sail smoothly into and through the new year. We hope that’s the case and next year brings with it a return to normal. Just remember, normal doesn’t mean risk-free. In 2021, investors will still need to balance risk and reward on the journey toward their financial goals – just as they do every year.

As we leave 2020 far behind and enter a blank slate of a new year, we can promote contentment and peace to replace the stresses of the closing year. Here are a few ways you can bring a moment of happiness into your life and to the lives of those around you:

Life is about people, and the small joys. Here’s to creating contentment in 2021!