Market Insights:

January 2, 2024

Posted on January 02, 2024

Planning and Guidance, Tailored To Your Life and Goals

Tuesday Takeaway

Posted on January 26, 2021

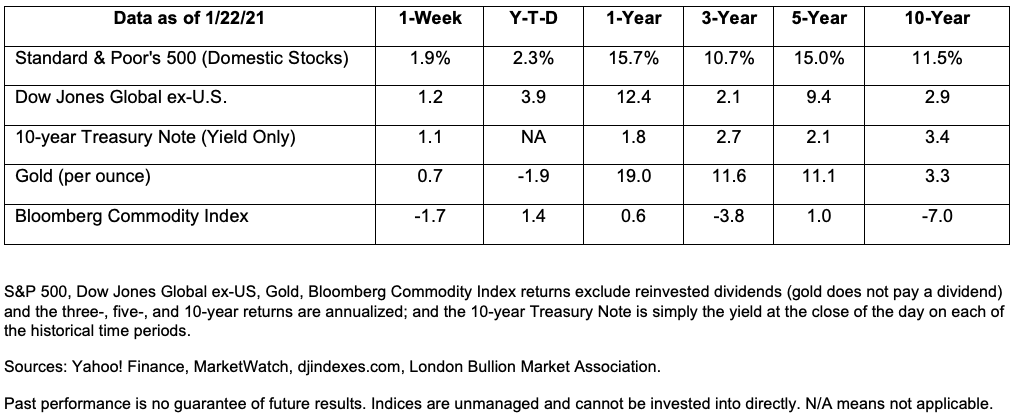

Last week, as COVID-19 vaccination efforts continued, there was speculation about stock market corrections and asset bubbles.

On Sunday morning, Bloomberg reported 63 million doses of the coronavirus vaccine had been administered across 56 countries. In the United States, 21.1 million shots have been delivered – about 51 percent of the vaccinations that were sent to states. At that point, the pace of vaccination in the United States was just over one million doses a day.

Improvements in the pace of vaccinations could lift market optimism, according to Ben Levisohn of Barron’s, but a market correction is still a possibility:

“…the S&P 500 has been following a pattern typical of recessions since 1990, one that sees the recovery occur in three phases: an initial recovery, a period of consolidation, and a second rebound. The initial recovery has lasted an average of 10 months, with an average return of 48 percent. That was followed by a period of consolidation that lasted from two to seven months and saw stocks sink an average of 17 percent. That was then followed by another rally…The current bounce from the March lows has lasted about 10 months and produced gains of just over 71 percent. If the market follows the historical pattern, it should pull back by spring – but that will be a buying opportunity.”

A survey from Deutsche Bank sparked talk about the possibility of asset bubbles. In a CNBC interview, Jim Reid, who heads global credit strategy at Deutsche Bank, shared results of the company’s January survey. Of the 627 market professionals who participated, the vast majority of respondents (89 percent) saw some asset bubbles in markets. Reid explained central bank policies and stay-at-home trading were responsible, in part, for rising asset prices.

Solid fourth quarter 2020 earnings may be supporting asset prices, too. So far, 13 percent of companies in the Standard & Poor’s 500 Index have reported results. John Butters of FactSet wrote, “At this point in time, more S&P 500 companies are beating EPS [earnings-per-share] estimates for the fourth quarter than average, and beating EPS estimates by a wider margin than average.”Last week, major U.S. stock indices moved higher. The Nasdaq Composite gained 4.2 percent, which was its biggest gain since November 2020.

At the end of 2020, the FINRA Investor Education Foundation published a report that found, “…financial literacy has significant predictive power for future financial outcomes, even after controlling for baseline financial characteristics and a wide set of demographic and individual characteristics that influence financial decision making.”

In fact, financial literacy may be more important today than it has ever been. That’s because the responsibility for saving, investing, and generating income for retirement has shifted from companies (that managed defined benefit plan assets) to individuals (who manage 401(k), 403(b), and other defined contribution plan assets).

The researchers administered a quiz at the beginning and end of the research period (six years). The quiz included questions that were a lot like these, which are derived from questions asked by the National Financial Capability Study:

If these answers generate questions for you, please give us a call.

Answers:

After the recent Consumer Electronics Show (CES) in Las Vegas went completely digital, with vendors small and large showing off their latest (not always market-viable) creations, some innovative gadgets caught more attention than others. Here are three of the top hits, per the Wall Street Journal:

Samsung’s AI-powered Bot Handy, though in the early developmental stages, can load dishwashers, pick up laundry, and pour wine. Watch the YouTube video to see Bot Handy in action.

Coldsnap’s machine dispenses instant, soft-serve ice cream in 60-90 seconds and will debut later this year at $500.

Razer’s N95 mask has active ventilators and projects the wearer’s voice to compensate for mask muffling.