Market Insights:

January 2, 2024

Posted on January 02, 2024

Planning and Guidance, Tailored To Your Life and Goals

Tuesday Takeaway

Posted on March 02, 2021

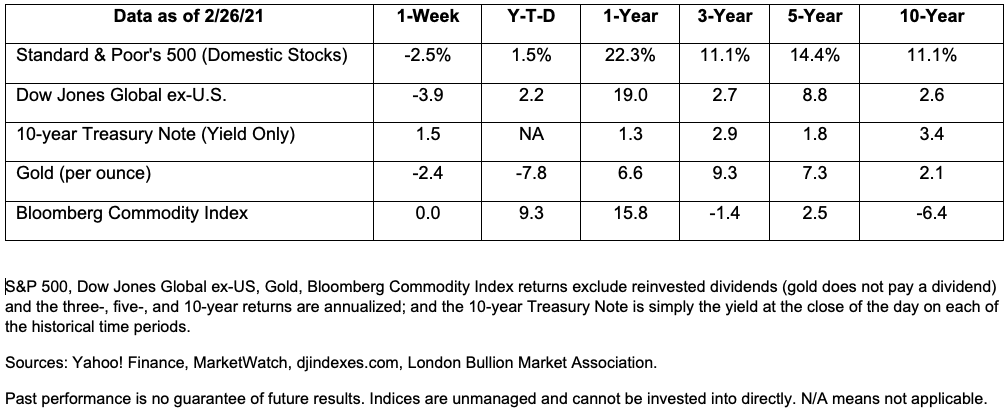

Students of financial markets may have noted a historically unusual event last week.

On Thursday, the yield on 10-year U.S. Treasury notes briefly matched the dividend yield for the Standard & Poor’s (S&P) 500 Index. This type of convergence is uncommon. In normal times, the yield on 10-year Treasuries tends to be higher than the dividend yield of the S&P 500. Felix Salmon of Axios explained:

“The 10-year Treasury note is a risk-free asset: If you hold it for 10 years, you know exactly how much it’s going to return…The S&P 500 dividend yield is normally lower than the risk-free rate. Investors earn less in dividends than [they] would holding the same amount of money in Treasury bonds, but they hope that rising stock prices will make up the difference.”

These, however, are not normal times.

Throughout much of 2020, the S&P 500 Index offered investors a return comparable to, or higher than, 10-year Treasuries. Low Treasury yields reflected the Federal Reserve’s highly accommodative monetary policy, which kept the fed funds rate near zero to support the economy through the pandemic. Since August 2020, however, the yield on 10-year T-notes has been creeping higher despite the Fed’s actions. Last week, it closed at 1.46 percent.

Rising yields appeared to concern investors last week. Ben Levisohn of Barron’s reported:

“Usually, we can point to a big event or a piece of economic data that shook up the market, but that wasn’t the case this time. The data were solid, with weekly jobless claims dropping more than expected, durable-goods orders rising more than forecast, and personal income getting a big boost from stimulus checks sent out in January…But there was the 10-year Treasury yield.”

Rising Treasury yields suggest bond investors think the economy is likely to strengthen and pent-up consumer demand could spark spending on shopping, dining, and social events. A spending spree could lead to higher inflation, reported Elliot Smith of CNBC. Rising yields also could signal weak demand for U.S. Treasuries, according to Levisohn.Last week, major U.S. stock indices finished lower.

Every year, The Economist Intelligence Unit (EIU) reports on the worldwide cost of living by surveying the cost of 138 goods and services in major cities around the world.

As of September 2020, prices were up just 0.3 percent, year-to-year. The cost of consumer staples remained fairly steady, overall. However, the prices for recreation (which includes personal electronics), personal care, tobacco, alcohol, and domestic help, increased. The report stated:

“Amid the pandemic, price-conscious consumers have also opted for cheaper products in many countries, increasing price competition for less-expensive goods…On the other hand, high-earning consumers have been comparatively unaffected by the pandemic. While they are likely to shop less, prices of premium products have remained resilient. Supply-chain problems have also had differing impacts on different goods, pushing up the price of high-demand products such as computers in some cities.”

Regionally, prices fell in Latin America, North America, Eastern Europe, and Africa. They increased in the Middle East, Asia, and Western Europe. The EIU’s World Cost of Living Index found, during 2020, the most expensive cities in the world were:

• Paris, France

• Hong Kong, China

• Zurich, Switzerland

• Singapore, Malaysia

• Osaka, Japan

• Tel Aviv, Israel

• New York, United States

• Geneva, Switzerland

• Los Angeles, United States

• Copenhagen, Denmark

The least expensive were:

• Damascus, Syria

• Tashkent, Uzbekistan

• Almaty, Kazakhstan

• Buenos Aires, Argentina

• Karachi, Pakistan

• Caracas, Venezuela

• Lusaka, Zambia

• Chennai, India

• Bangalore, India

• New Delhi, India

Physical assets may soon be considered old-school. Blockchain has made it possible for artists to sell their “rare” one-of-a-kind artwork as a digital asset, or a Non-Fungible Token (NFT). The blockchain records ownership, tracks the piece’s provenance, and allows artists to continue to make money every time the piece is sold.

Artist Beeple has been selling his digital art online and was the first artist ever to have his work auctioned by Christie’s. Beeple’s digital artwork titled “EVERYDAYS: THE FIRST 5,000 DAYS” opened for bids on February 25, and will remain open until March 11. As of yesterday, March 1, the bid was up to $1.8 million. This could be the start of something big in the art world.

To learn more about Beeple, NFTs, and speculation about the future of digital assets as investments, read this New York Times article: https://www.nytimes.com/2021/02/24/arts/design/christies-beeple-auction-blockchain-art.html).