Market Insights:

January 2, 2024

Posted on January 02, 2024

Planning and Guidance, Tailored To Your Life and Goals

Tuesday Takeaway

Posted on October 06, 2020

Last week, the third quarter of 2020 came to an end – and the fourth quarter delivered a doozy of an October surprise.

President Trump has the coronavirus

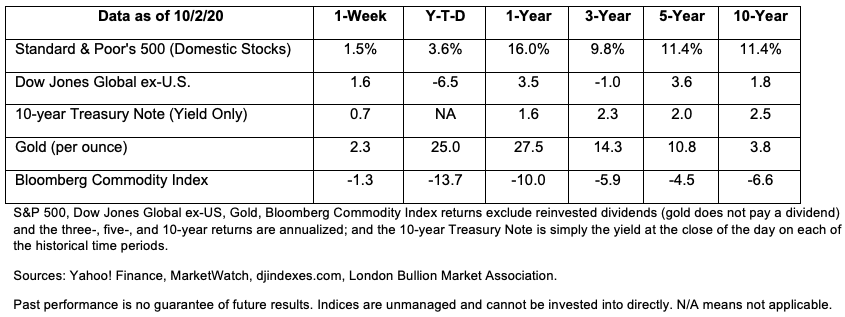

On Friday Americans awoke to the news President Trump had contracted COVID-19. Financial markets responded with relative equanimity. After a brief sell-off on Friday, major U.S. indices finished the week, and the third quarter, higher.

Market enthusiasm cooled in September

U.S. stock markets moved higher in July and August. Then, in early September, investors became skittish and major U.S. indices recorded losses for several weeks. The surge of uncertainty may have resulted from changing vaccine expectations, concerns about earnings, fears of a disputed election, and lack of new stimulus, reported Ben Levisohn of Barron’s.

The Federal Reserve committed to low rates for a long time

The Federal Reserve’s changing policies may have had an influence on markets, as well. The Fed intends to keep interest rates near zero for the foreseeable future. The Federal Open Market Committee (FOMC) statement provided a big picture explanation, “The path of the economy will depend significantly on the course of the virus. The ongoing public health crisis will continue to weigh on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term.”

Yields on 10-year U.S. Treasuries moved in a narrow range during the quarter, finishing near where they started.

Stimulus talks resumed last week

Treasury yields rose and stock markets perked last week when Congress resumed stimulus talks. Investors expect $1.3 to $1.5 trillion in new stimulus, according to BCA Research cited by Kiplinger’s.

Additional stimulus measures were expected early in the third quarter, after CARES Act provisions ran dry in July. However, better-than-expected economic data and a reluctance to increase the burgeoning budget deficit made some in Congress adopt a wait-and-see approach, reported Victor Reklaitis of MarketWatch.

By last Friday, stimulus negotiations appeared to have stalled again. However, there were new calls for action over the weekend, following Friday’s weaker-than-expected employment report, according to Jacob Pramuk of CNBC.

The pace of recovery may be slowing

Throughout the third quarter, employment improved steadily. In July it was 10.2 percent. By September, it had fallen to 7.9 percent. While continued improvement is important, the pace of jobs creation slowed last month. Consensus estimates for September suggested the economy would produce 850,000 new jobs. It came up short at 661,000. That could be a sign economic growth is slowing.

Economic growth improved during the third quarter

During the second quarter (April through June), the U.S. economy shrank by about a third (-31.7 percent). Data for third quarter economic growth is not yet available, but it is expected to show a significant improvement. The Atlanta Federal Reserve’s GDPNow estimates third quarter growth could be as high as 34.6 percent.

While a double-digit rebound would be welcome news, Aaron Weitzman of The Bond Buyer pointed out a 34.6 percent rebound does not offset a 31.7 percent contraction. The economy needs to grow by 46 percent to get back to even.

Volatility is likely to continue

Global markets may be volatile through the end of 2020.

Almost everyone has come across a test question they couldn’t answer. Some ingenious souls provide their teachers with some humor instead. British author Richard Benson asked teachers to share their favorite wrong test answers, and he shared a few with Business Insider:

Q: When did the founding fathers draft the Constitution?

A: It was a second round pick, right after LeBron James.

Q: Describe what is meant by “forgetting.”

A: I can’t remember.

Q: What is a nitrate?

A: It is much cheaper than a day rate.

Q: Upon ascending to the throne, the first thing Queen Elizabeth II did was to…

A: Sit down.

Q: Where was the Declaration of Independence signed?

A: At the bottom.

A new Harvard Business School study, discussed in in this Ladders article (https://www.theladders.com/career-advice/harvard-researchers-just-found-shocking-downside-of-being-financially-successful), finds that people who focus on making money could be short-circuiting their personal relationships.

The original study reports, “Although people may think that money improves one’s relationships, research suggests otherwise. Focusing on money is associated with spending less time maintaining relationships and less desire to rely on others for help.”

The study, titled Can’t Buy Me Love (or Friendship): Social Consequences of Financially Contingent Self-Worth, was published in the Personality and Social Psychology Bulletin journal.

At Bradley Wealth, we encourage our clients to focus on their personal values of TrueWealth; those things money can’t buy and death can’t take away. We believe people, and nurturing deep relationships, are what make us truly rich. Of course, we also work hard to ensure our clients’ portfolios remain strong and support their Ideal Life plan.