Market Insights:

January 2, 2024

Posted on January 02, 2024

Planning and Guidance, Tailored To Your Life and Goals

Tuesday Takeaway

Posted on April 28, 2020

The Markets

We live in interesting times.

There is discussion about whether the saying, “May you live in interesting times,” is a blessing or a curse. At this point in 2020, we all understand why.

Last week, the world watched in consternation as the price of oil, specifically West Texas Intermediate crude oil, dropped into negative territory. The price moved below zero because a purchase date coincided with a lack of storage space. As a result, the owners of the oil had to pay to have it taken off their hands, reported Ben Levisohn of Barron’s.

Oil prices recovered on Wednesday. Global oil producers have promised to reduce output, which would realign supply and demand, but it has yet to happen, reported Evie Liu of Barron’s. The delay may reflect a hope that coronavirus restrictions will ease, economies will begin to reopen, and the demand for oil will increase.

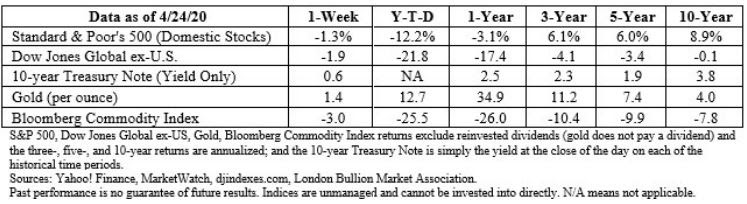

Investors were understandably unsettled by oil prices, and U.S. stocks lost value early in the week. As oil stabilized, U.S. stocks pushed higher. The rebound in stocks stalled on news that trials for a potential COVID-19 treatment had produced disappointing results.

Thursday’s unemployment data showed 4.4 million people filed for unemployment benefits the previous week. That brought the number of unemployed Americans to more than 26 million, according to Jeffry Bartash of MarketWatch.

Earnings, which reflect companies’ profits, remained less than robust, as expected. “The blended (combines actual results for companies that have reported and estimated results for companies that have yet to report) earnings decline for the first quarter is -15.8 percent…” reported John Butters of FactSet.

The energy sector finished the week in positive territory.