Market Insights:

January 2, 2024

Posted on January 02, 2024

Planning and Guidance, Tailored To Your Life and Goals

Tuesday Takeaway

Posted on May 19, 2020

The Markets

Weak consumer demand is also a concern, according to Matthew Klein of Barron’s. “…The pandemic has lowered consumer demand much more than it has damaged productive capacity. It’s much easier to bring factories back online than it is to get customers back into shops and auto dealerships…Unless consumption rebounds quickly, the world will soon be faced with an unprecedented glut of goods that can’t be sold.”

Some households may be able to sustain or increase consumption because of generous unemployment benefits. The Coronavirus Aid, Relief, and Economic Security (CARES) Act increased unemployment benefits by $600 per week. The intent was to provide Americans, who were out of work because of the pandemic, with income equal to the national average salary of $970 per week, reported Amelia ThomsonDeVeaux of FiveThirtyEight.

As it turns out, about 68 percent of those filing for unemployment – teachers, construction workers, medical assistants, food service workers, and others – are receiving more money through unemployment than they did from employers.

An analysis conducted by economists at the University of Chicago, and cited by FiveThirtyEight, found, “…the estimated median replacement rate – the share of a worker’s original weekly salary that is being replaced by unemployment benefits – is 134 percent or more than one-third above their original wage.”

In recent weeks, the number of unemployed workers has grown to about 36 million, according to CBS News. Unusually high unemployment combined with unusually high unemployment benefits may mean some Americans may have more money to spend than they might have had otherwise. The combination could improve the demand for goods. It also could make it more difficult for employers to persuade employees to return to work.

Last week, major U.S. stock indices finished lower.

Weak consumer demand is also a concern, according to Matthew Klein of Barron’s. “…The pandemic has lowered consumer demand much more than it has damaged productive capacity. It’s much easier to bring factories back online than it is to get customers back into shops and auto dealerships…Unless consumption rebounds quickly, the world will soon be faced with an unprecedented glut of goods that can’t be sold.”

Some households may be able to sustain or increase consumption because of generous unemployment benefits. The Coronavirus Aid, Relief, and Economic Security (CARES) Act increased unemployment benefits by $600 per week. The intent was to provide Americans, who were out of work because of the pandemic, with income equal to the national average salary of $970 per week, reported Amelia ThomsonDeVeaux of FiveThirtyEight.

As it turns out, about 68 percent of those filing for unemployment – teachers, construction workers, medical assistants, food service workers, and others – are receiving more money through unemployment than they did from employers.

An analysis conducted by economists at the University of Chicago, and cited by FiveThirtyEight, found, “…the estimated median replacement rate – the share of a worker’s original weekly salary that is being replaced by unemployment benefits – is 134 percent or more than one-third above their original wage.”

In recent weeks, the number of unemployed workers has grown to about 36 million, according to CBS News. Unusually high unemployment combined with unusually high unemployment benefits may mean some Americans may have more money to spend than they might have had otherwise. The combination could improve the demand for goods. It also could make it more difficult for employers to persuade employees to return to work.

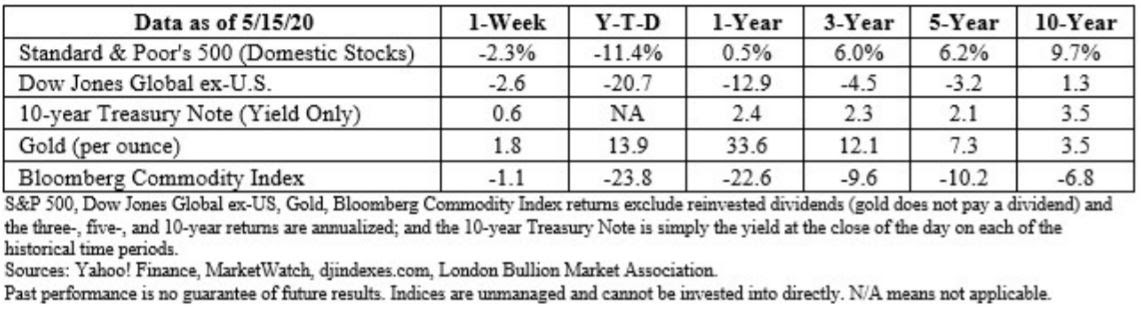

Last week, major U.S. stock indices finished lower.