Market Insights:

January 2, 2024

Posted on January 02, 2024

Planning and Guidance, Tailored To Your Life and Goals

Tuesday Takeaway

Posted on August 31, 2016

“…Indeed, in light of the continued solid performance of the labor market and our outlook for economic activity and inflation, I believe the case for an increase in the federal funds rate has strengthened in recent months. Of course, our decisions always depend on the degree to which incoming data continues to confirm the Committee’s outlook.”

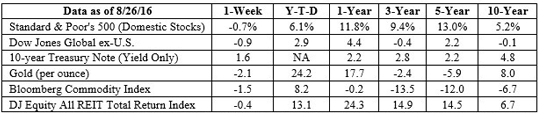

There’s a good chance the increase could occur during 2016. Goldman Sachs economists, cited by Bloomberg, said the subjective odds of a September rate hike increased from 30 percent to 40 percent last week. Bloomberg’s data suggests a 65 percent chance of a rate hike by December. The U.S. bond market responded with a flattening of the yield curve. When the bond yield curve is flat, short-term and long-term bonds of similar credit quality offer investors almost the same rates. Barron’s explained: “A flattening yield curve can indicate economic weakness. It signals investors expect inflation (and interest rates) to stay low for a long time.” Why would the yield curve flatten as the Fed raises rates? One expert told Barron’s he expects a Fed rate hike to lower inflation expectations, causing interest rates on longer-term benchmark Treasuries to move lower.Stock investors weren’t thrilled about Yellen’s comments last week, and major U.S. indices largely finished the week lower.

“Firms are on a six-year hiring spree that shows little sign of abating; payrolls swelled by an average of 190,000 a month between May and July. Competition for workers is pushing up wages. The median pay rise in the year to July was 3.4%, according to the Federal Reserve Bank of Atlanta. Americans are spending that cash; in the second quarter, consumption per person grew at an annual pace of 5.5%, equaling its fastest growth in a decade. Yet real GDP is expanding by only 1.2% a year. The culprit seems to be business investment, which has fallen for three consecutive quarters.”Protect yourself with some dos and don’ts of free public Wi-Fi:

The Economist reflected on the effects of low oil prices, questioning whether weak demand for goods or tighter credit was the culprit behind low business spending. It concluded that slow trend growth (the rate at which the U.S. economy is expected to grow over a period of time) is producing fewer opportunities for profitable long-term investment, and offered the opinion that a solution could be found in fiscal policy:“Businesses anticipating slower long-term growth cannot be expected to invest much. And politicians cannot easily conjure up technological progress. But they can boost competition, simplify taxes and regulation, and invest in infrastructure and education, all of which would help to raise American productivity.”

Of course, getting politicians to agree on a course of action and implement a coherent fiscal policy is a tall order. ]]>

]]>