Market Insights:

January 2, 2024

Posted on January 02, 2024

Planning and Guidance, Tailored To Your Life and Goals

Tuesday Takeaway

Posted on March 29, 2016

“Aggregate domestic profits are at near-record levels relative to GDP… High profits might be a sign of brilliant innovations or wise long-term investments were it not for the fact that they are also suspiciously persistent. A very profitable American firm has an 80 percent chance of being that way 10 years later. In the 1990s the odds were only about 50 percent.”

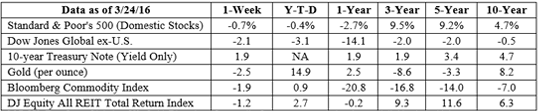

At the end of last week, U.S. headlines indicated concern about declining corporate profits: * Consumers prop up U.S. economy, but profits under pressure * U.S. Fourth-Quarter GDP Revised Up to 1.4% Growth but Corporate Profits Fall * Corporate profits fall in 2015 for first time since Great Recession * U.S. Corporate Profits Fall 8.1% in 4th Quarter So, are U.S. companies experiencing record profits or are they in trouble? Last week’s press release from the Bureau of Economic Analysis indicated corporate profits (after inventory valuation and capital consumption adjustments) declined from the third quarter of 2015 to the fourth quarter of 2015; hence, the headlines. However, a one-quarter decline doesn’t provide a complete picture of the health of corporate America. As CFO.com pointed out, over the full year, corporate profits were up 3.3 percent year-to-year. Trading Economics offered additional context. From 1950 through 2015, U.S. corporate profits averaged about $395 billion annually. Profits hit a record low for that period, $14 billion, during the first quarter of 1951. Profits rose to an all-time high of about $1.64 trillion during the third quarter of 2014. Fourth quarter’s profits of $1.38 trillion remain well above that average.

]]>

]]>