Tailored Financial Planning for Your Unique Journey

Financial planning isn’t one-size-fits-all—it’s as unique as your journey. We craft personalized strategies that align seamlessly with your lifestyle, goals, and long-term vision.

Financial Planning

True wealth is about more than money—it’s about living a life aligned with your values and building a legacy that lasts. At Bradley Wealth, we focus on what matters most to you, creating a personalized financial plan that reflects your goals, lifestyle, and vision for the future. From

protecting what you’ve built to planning for what’s next, we guide you every step of the way with experienced advice and tailored strategies. Together, we’ll help you achieve your financial dreams and create a meaningful legacy for generations to come.

True wealth is about more than money—it’s about living a life aligned with your values and building a legacy that lasts. At Bradley Wealth, we focus on what matters most to you, creating a personalized financial plan that reflects your goals, lifestyle, and vision for the future. From protecting what you’ve built to planning for what’s next, we guide you every step of the way with experienced advice and tailored strategies. Together, we’ll help you achieve your financial dreams and create a meaningful legacy for generations to come.

Your Personal Wealth Plan is ready

Differentiators

Why We're Different

Personalized Strategies for Your Unique Journey

We believe every financial journey is different. That’s why we take the time to understand your lifestyle, goals, and values, crafting strategies tailored specifically to your needs. Your financial plan is as unique as you are.

Guidance Backed by Experience

With years of experience in wealth management, our team provides proactive advice to help you navigate the complexities of financial planning. We combine deep knowledge with a hands-on approach to guide you toward your goals with clarity and confidence.

A Holistic Approach to True Wealth

We go beyond numbers to focus on what matters most to you—your values, relationships, and legacy. Our comprehensive approach checks that every aspect of your financial life is aligned, empowering you to achieve your vision of success and leave a meaningful impact.

Goals-Based

Financial Planning

For Individuals

& Families

For Individuals

& Families

Personalized Financial Strategies

Your financial journey is unique, and so is our approach. We craft tailored strategies designed to align with your lifestyle, goals, and aspirations, so that every decision moves you closer to your vision.

Comprehensive Wealth Management

From investments and retirement to tax and estate planning, we take a 360-degree view of your finances. Our holistic approach checks that every aspect of your wealth works together seamlessly.

Proactive Risk Management

Protecting your future is just as important as growing your wealth. We identify potential risks and implement strategies to safeguard your assets and provide peace of mind for you and your loved ones.

Ongoing Guidance and Support

Financial planning isn’t a one-time event—it’s a lifelong partnership. We’re here to provide advice, regular reviews, and proactive adjustments to keep you on track as your life evolves.

For Businesses

For Businesses

Strategic Financial Planning for Growth

We help you align your business’s financial strategy with your long-term goals, providing tailored solutions to drive sustainable growth and profitability.

Risk Management and Protection

Customized risk management plans. From insurance to contingency strategies, we support your business in preparing for the unexpected.

Comprehensive Tax Planning

Optimize your business finances with proactive tax strategies designed to minimize liabilities and maximize savings, keeping more resources available for reinvestment.

Succession and Exit Planning

Plan for the future with confidence. We help you navigate the complexities of succession planning, business valuation, and exit strategies to secure your legacy.

Integrated Planning for Every Stage of Life

Life and business evolve, and so do your financial needs. Whether you’re focused on building wealth, scaling a business, or preserving your legacy, we create strategies that adapt to every phase of your journey. Our team takes a holistic approach, aligning personal and professional goals so that all aspects of your financial life work seamlessly together. With our guidance, you’ll have a plan that grows with you, providing clarity and confidence at every stage.

Expertise You Can Rely On

Minimizing taxes and maximizing your legacy are at the heart of our estate planning services. We guide you through the complexities of estate taxes, offering tailored strategies to preserve your wealth. From gifting programs to charitable giving and tax-efficient trusts, we help support you so that your assets are transferred to your beneficiaries with minimal tax impact, protecting the legacy you’ve worked so hard to build.

Tailored Strategies That Build Confidence

Financial management can feel overwhelming, but it doesn’t have to be. We specialize in turning intricate financial challenges into clear, actionable strategies tailored to your unique needs. From coordinating business and personal finances to streamlining tax planning and investments, we simplify the process so you can focus on what matters most—achieving your vision of success. Let us handle the complexities while you enjoy peace of mind.

The Bradley Wealth Way

Step 1

Introduction

At Bradley Wealth, we begin working for you from day one, connecting you with a dedicated advisor who will take the time to understand your goals and craft a personalized financial plan that aligns with your vision for an ideal life.

Step 2

Discovery

The first and most important step is building a strong relationship between you and your advisor. We take the time to understand what’s most important to you—your aspirations, values, and dreams—so we can design a financial plan that supports your retirement, career transitions, estate planning, or entrepreneurial goals.

Your Career

Years in Medical Industry

Step 3

Data Gathering

To create a comprehensive roadmap for your financial future, we analyze every facet of your financial life, including your goals, risk tolerance, and resources. A holistic understanding allows us to build a plan that addresses where you are today and how to reach your desired destination.

Ralph

Edwards

Balanced portfolio

Step 4

Wealth Plan Reveal

With a deep understanding of your assets and aspirations, we design a custom wealth plan tailored to your goals. This roadmap outlines the steps needed to achieve your ideal life and provides clarity and direction for the journey ahead.

Step 5

Implementation

Through regular updates and communication, we help keep your plan aligned with your goals, adapting to life changes and shifting market conditions, so you stay on track to pursue your long-term goals.

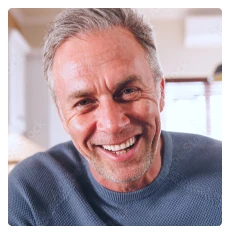

Real Voices.

Real Relationships.

“If you are serious about creating wealth for yourself and building a financial future for your family. Look no further than Bradley Wealth.

I’ve known Michael Bradley for over 12 years. His character and strong intellect into wealth management goes beyond how he carries himself. This plays directly into the standards he carries for his firm. I’ve watched him and his 5 star team yield returns and results over results to all of their clients. The customer service at Bradley Wealth goes above and beyond expectations at delivering whatever you need to cater to your portfolio. His team is dialed in to ensure everything you need is attended and handled with efficiency and urgent need…”

Mike Bernknopf

“The Team at Bradley Wealth is fantastic! They keep us updated every 3 months or so about how our money is doing in the market. This makes me feel very confident in their ability to manage our retirement account. The team has made it possible to retire a lot sooner than I expected! You can rest assured that the team will take good care of you! We love them!”

Lisa Miller

“We have been a client of Bradley Wealth since June 2024, and we couldn’t be happier with the exceptional support received. The professionalism of their team is evident in every interaction, making complex financial concepts easy to understand. Their responsiveness and dedication to our financial success have been outstanding!

The kindness and generosity shown by the team have truly set them apart. They take the time to listen and offer tailored advice that suits our unique needs. It’s refreshing to work with a company that treats you like family, fostering a genuine sense of friendship.

Overall, I wholeheartedly recommend Bradley Wealth to anyone seeking a reliable and compassionate partner in their financial journey. 😊”

Stephanie Carlock

Reed Hartzog

“We’ve been clients of Bradley Wealth, a financial advisory firm, for 13 years. As a small boutique firm, they excel in providing exceptional customer service and truly make their clients feel like part of the family.

Bradley Wealth offers a comprehensive suite of financial services, including traditional and alternative investments, insurance, and more. Their personalized approach ensures that each client’s unique needs are met, and their dedication to fostering strong relationships is evident in every engagement.

I highly recommend Bradley Wealth to anyone seeking a trustworthy and client- focused financial advisor. Their commitment to excellence and client satisfaction is second to none.”

Todd Stevens

*These testimonials were provided via Google Reviews. Clients were not compensated, and experiences may not reflect those of all clients. Testimonials do not guarantee future performance. Full reviews, including all ratings, are available here.