Our Method.

Your Vision.

Your financial journey deserves a process as unique as your goals. Our structured, client-focused approach makes every step purposeful, personalized, and aligned with your vision for the future.

Your Financial Journey,

Simplified

At Bradley Wealth, we’ve developed a structured, client-focused process so that your financial journey is clear, purposeful, and aligned with your unique goals. From understanding your vision to implementing tailored strategies, every step is designed to provide clarity, confidence, and measurable results. We begin by listening to your priorities, analyzing your current financial picture, and

identifying opportunities for growth and improvement. From there, we craft a customized plan, implementing strategies with precision and adapting as your life evolves. With ongoing communication and proactive adjustments, we help your financial plan stay on track, supporting both your short-term needs and long-term aspirations.

At Bradley Wealth, we’ve developed a structured, client-focused process so that your financial journey is clear, purposeful, and aligned with your unique goals. From understanding your vision to implementing tailored strategies, every step is designed to provide clarity, confidence, and measurable results. We begin by listening to your priorities, analyzing your current financial picture, and identifying opportunities for growth and improvement. From there, we craft a customized plan, implementing strategies with precision and adapting as your life evolves. With ongoing communication and proactive adjustments, we help your financial plan stay on track, supporting both your short-term needs and long-term aspirations.

Introduction

01

Discovery

02

Data Gathering

03

Wealth Plan Reveal

04

Step 1

Introduction

At Bradley Wealth, we begin working for you from day one, connecting you with a dedicated advisor who will take the time to understand your goals and craft a personalized financial plan that aligns with your vision for an ideal life.

Step 2

Discovery

The first and most important step is building a strong relationship between you and your advisor. We take the time to understand what’s most important to you—your aspirations, values, and dreams—so we can design a financial plan that supports your retirement, career transitions, estate planning, or entrepreneurial goals.

Your Career

Years in Medical Industry

Ralph

Edwards

Balanced portfolio

Step 3

Data Gathering

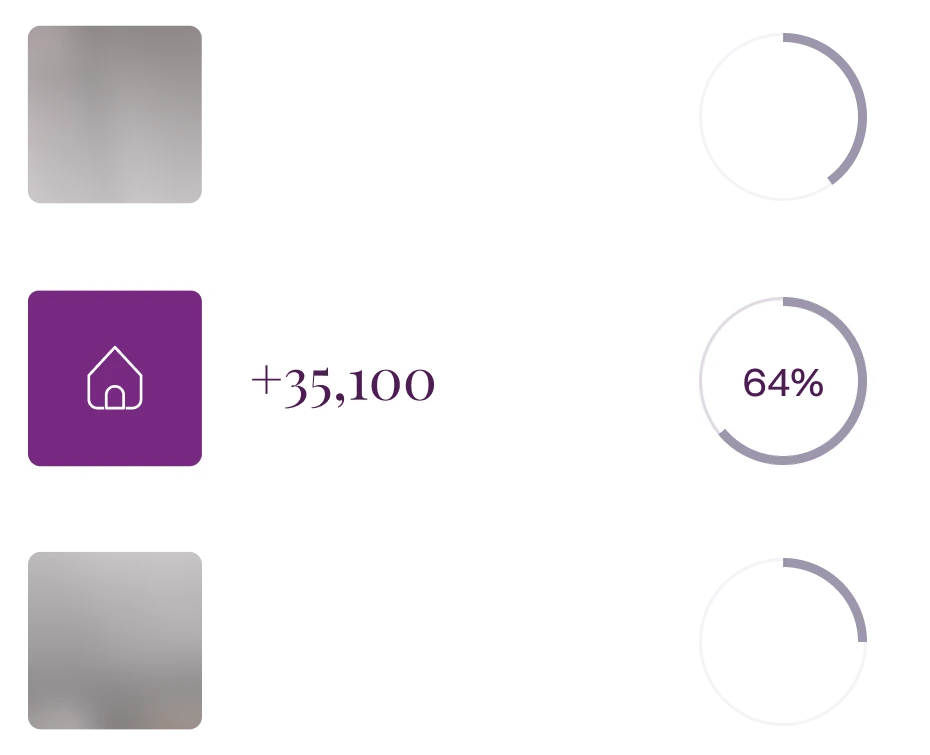

To create a comprehensive roadmap for your financial future, we analyze every facet of your financial life, including your goals, risk tolerance, and resources. A holistic understanding allows us to build a plan that addresses where you are today and how to reach your desired destination.

Step 4

Wealth Plan Reveal

With a deep understanding of your assets and aspirations, we design a custom wealth plan tailored to your goals. This roadmap outlines the steps needed to achieve your ideal life and provides clarity and direction for the journey ahead.

Step 5

Implementation

Once your plan is in motion, we remain actively engaged, monitoring progress and adjusting as needed. Through regular updates and communication, we help your plan stay aligned with your goals, adapt to life changes, and navigate shifting market conditions, so you remain on track to achieve your vision.

Real Voices.

Real Relationships.

“If you are serious about creating wealth for yourself and building a financial future for your family. Look no further than Bradley Wealth.

I’ve known Michael Bradley for over 12 years. His character and strong intellect into wealth management goes beyond how he carries himself. This plays directly into the standards he carries for his firm. I’ve watched him and his 5 star team yield returns and results over results to all of their clients. The customer service at Bradley Wealth goes above and beyond expectations at delivering whatever you need to cater to your portfolio. His team is dialed in to ensure everything you need is attended and handled with efficiency and urgent need…”

Mike Bernknopf

“The Team at Bradley Wealth is fantastic! They keep us updated every 3 months or so about how our money is doing in the market. This makes me feel very confident in their ability to manage our retirement account. The team has made it possible to retire a lot sooner than I expected! You can rest assured that the team will take good care of you! We love them!”

Lisa Miller

“We have been a client of Bradley Wealth since June 2024, and we couldn’t be happier with the exceptional support received. The professionalism of their team is evident in every interaction, making complex financial concepts easy to understand. Their responsiveness and dedication to our financial success have been outstanding!

The kindness and generosity shown by the team have truly set them apart. They take the time to listen and offer tailored advice that suits our unique needs. It’s refreshing to work with a company that treats you like family, fostering a genuine sense of friendship.

Overall, I wholeheartedly recommend Bradley Wealth to anyone seeking a reliable and compassionate partner in their financial journey. 😊”

Stephanie Carlock

Reed Hartzog

“We’ve been clients of Bradley Wealth, a financial advisory firm, for 13 years. As a small boutique firm, they excel in providing exceptional customer service and truly make their clients feel like part of the family.

Bradley Wealth offers a comprehensive suite of financial services, including traditional and alternative investments, insurance, and more. Their personalized approach ensures that each client’s unique needs are met, and their dedication to fostering strong relationships is evident in every engagement.

I highly recommend Bradley Wealth to anyone seeking a trustworthy and client- focused financial advisor. Their commitment to excellence and client satisfaction is second to none.”

Todd Stevens

*These testimonials were provided via Google Reviews. Clients were not compensated, and experiences may not reflect those of all clients. Testimonials do not guarantee future performance. Full reviews, including all ratings, are available here.