Are You Ready to File Your 2021 Federal Tax Return?

Posted on April 07, 2022

Planning and Guidance, Tailored To Your Life and Goals

News

Posted on September 16, 2020

Election day is less than two months away. In political time, this is an eternity. However, with the White House, about one-third of the Senate, and the entire House of Representatives on the ballot, this election is significant. Particularly because the two presidential candidates have such stark differences in policy perspectives, especially with respect to taxes.

The backdrop for the 2020 election has shifted dramatically, as the next administration’s policies will shape the economic recovery and build the foundation for the next expansion.

I thought it would be timely to provide you with an update and insights on the top questions about the 2020 election and the economic and market implications of the results.

Typically, incumbent candidates have a high likelihood of winning re-election. In fact, incumbents have won re-election 65% of the time since the Civil War. However, in all instances in which the incumbent lost, there was a recession or depression during their term.

Coming into this year, economic growth was slowing but solid, and unemployment was at a 50-year low. Now, the U.S. is in the deepest recession since World War II, with double-digit unemployment. In addition to the economic downturn, the country is still mired in the worst public health crisis in decades while also confronting civil unrest over racial inequality.

In light of these multiple crises, former Vice President Joe Biden is gaining popularity and President Trump’s approval ratings have slid. Now, instead of running on a strong economy, President Trump will either have to convince voters he has managed this crisis appropriately or rely on his signature issues such as immigration, trade protectionism, and infrastructure.

While signature issues may resonate with his fiercely loyal base, economic realities could be more decisive in swing states. Among the ten states with the tightest margins in the 2016 presidential race, the majority have double-digit unemployment rates and all experienced their highest unemployment rates on record (dating back to 1976) in April or May.

However, the perception of the COVID-19 crisis has also been highly partisan in some respects, so it is important to highlight that seven out of those ten states have Democratic governors. Governors have controlled the pace and parameters of lockdowns and reopenings. Therefore, swing state voters’ frustrations may either lie with President Trump or the Democratic governor leading their state.

Polling and betting odds suggest an increased possibility of a Democratic sweep of the presidency, the Senate, and the House of Representatives. However, it is important to consider the pathways, rather than the polls, to this outcome.

As for Congress, in the Senate, the Republicans currently hold the majority with 53 seats. In order for the Democrats to win the majority, they must win net three seats if they also win the presidency (because the Vice President casts the tie-breaking vote in legislation), or net four seats if they do not.

This year, 35 seats are up for election, 23 currently held by Republicans and 12 by Democrats. There appear to be at least seven competitive races (AZ, CO, GA, IA, ME, MT, NC) where Democrats could possibly flip Republican seats, but it is likely that Republicans will flip the Democratic seat in Alabama.

In the House, all 435 seats are up for election. Democrats currently hold 232 seats, Republicans hold 198, and there are four vacancies and one Libertarian. Assuming the vacant seats return to the party that held them, that would give the Democrats 233 seats and the Republicans 201. This would leave the Republicans needing a net gain of 17 seats to regain control. While that’s possible, on average we see much bigger swings during mid-term election years, as these contests are considered referendums on the president’s first two years of the term.

During the last three presidential elections, the House swung on average by net 12 seats. However, in the 2018 mid-term elections, the Republicans would have needed to win 19 seats for control of the House, which they could have achieved even if the Democrats had won by up to 3.8% of the vote. Therefore, even if the Democrats win a majority of the votes, they need to win by a wide enough margin to maintain control.

A lot has to go right for either party to sweep government control, but in this highly polarized environment, victory at the top of the ticket could lead to momentum down the ballot.

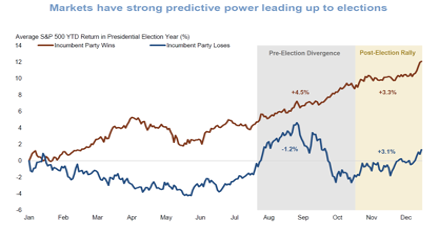

On average, returns have been lower and volatility has been higher during election years compared to non-election years. But what do averages really tell us? Sure, political volatility does impact markets, but let’s consider recent election years, such as 2008 and 2000. 2008 was marked by the onset of the Financial Crisis, and 2000 by the tech bubble bursting.

Returns and volatility during those years were driven by prevailing market and economic conditions at the time, not the election. This year, lower returns and higher volatility will almost certainly be attributable to COVID-19.

Therefore, investors should instead continue to monitor economic fundamentals, tilt towards quality in both equity and fixed income, and maintain a well-diversified allocation. This doesn’t mean there won’t be interim volatility around the election, but that volatility is unlikely to warrant dramatic portfolio changes.

Moreover, timing the market is a very difficult strategy, and no less so during an election. Recall that in the early hours of November 9, 2016, futures plummeted as election results were coming in, but markets closed positive after that day’s regular trading session. Investment time horizons extend far beyond election cycles and presidential terms, so sticking to an investment plan is more crucial than ever.

One might extrapolate that investors may be under-allocated to risk assets or even pull out of the market if they feel extremely negative about a president. However, investors would have missed out on above-average returns on the S&P 500 during the Obama Administration and the first three years of the Trump Administration if their political views governed their investment decisions.

Biden’s team has made plenty of tax proposals, but we’re going to focus on what we call the Big Five:

1. Raising the top income tax rate on regular income back to 39.6% from 37%

2. Raising the corporate tax rate to 28% from 21%

3. Ending the step-up basis at death

4. Treating long-term capital gains and qualified dividends as regular income for those earning over $1 million

5. Applying the Social Security payroll tax on incomes over $400,000+

If the Democrats win the Senate, a Biden Administration is likely to be successful at raising the top personal rate as well as the corporate rate. We think lifting the top income tax rate back to 39.6% would hinder economic growth, but the effect would be small. That’s where the rate was under Clinton and in President Obama’s second term, and no recession happened in either period.

On raising the corporate rate to 28%, we suggest looking at the glass as half-full. Although we’d prefer the corporate rate to stay at 21%, did anyone seriously believe the corporate rate would stay there forever? The corporate tax rate was stuck at 35% from the early 1990s through 2017 and hadn’t been as low as 21% since the 1930s. The market is a discounting machine. If Democrats take back power and only raise it to 28%, that’s a win, in a way, because it means future policy debates on the corporate tax rate will range from 21% to 28%, not up to 35%.

President Biden also wants to apply a minimum profits tax of 15% on larger companies’ GAAP earnings, but we think this policy would have more bark than bite. The idea is that some companies are using legitimate tax maneuvers, like fully expensing investment, so they show very low (or no) taxable profits even though their GAAP earnings are high (because GAAP has them depreciate investment costs gradually over time). But companies would react by manipulating their books to show weaker GAAP profits, knowing savvy investors would see through the ruse. Companies could also spin-off big investment projects to other companies that have large taxable profits, and then lease the investment.

Although the Biden Administration would want to raise taxes on capital gains, we think he’d need more than a narrow 51 or 52 seat Senate majority to pass those changes and, even then, would have a tough time eliminating step-up basis at death or treating capital gains and ordinary dividends as regular income for those earning $1 million or more.

Eliminating the step-up basis at death would be an administrative nightmare for some heirs who inherit assets with no records of when the assets were originally bought or at what price. And many of these heirs are far from wealthy themselves. More likely, the Senate would instead reduce the exemption amounts for the estate tax.

More troublesome from an economic growth perspective would be treating capital gains and qualified dividends as regular income for those making $1 million or more. For dividends, this would unravel about twenty years of tax policy reducing the double-taxation on dividends, because monies are taxed when a company earns profits and then again at the personal level. On long-term capital gains, the tax rate hasn’t been as high as 39.6% since the early years of the Carter Administration. That’s right, even Jimmy Carter thought that tax rate was too high!

Raising it that high would be a major disincentive for investors. And, given that the economy will be far from fully healed in 2021, we have serious doubts the Biden Administration could rally relatively moderate Democrats to such a tax hike. Remember, President Obama had 59 (and then 60) Senate votes and a large majority in the House, when he became president in 2009. And yet the Bush tax cuts he inherited were not unwound until 2013. And then, only partially.

The most aggressive proposal would be to impose the Social Security tax on regular earnings above $400,000. At present, that tax – 6.2% on workers, 6.2% on employers – applies only on the ‘wage base” up to $137,700 in 2020, with the wage base going up each year based on wage growth.

Imposing an extra 12.4% tax would be a large disincentive for high-income workers. Tack that on top of the official 39.6% income tax rate, plus the 2.9% Medicare tax, and we’re at more than 50% (our math is factoring in that some of the cost is paid by the employer, but the cost is ultimately borne by the worker). Then add in a top tax rate of 13.3% for California, which may be going higher, and you have net marginal tax rates nearing 65%.

However, it’s unlikely the Biden Administration would be able to impose this extra layer of payroll tax. The special budget rules in the US Senate do not apply to any aspect of Social Security; not benefits and not taxes. Changing any aspect of Social Security requires going through “regular order” in the Senate, which means the proposal could be filibustered until it gets 60 Senators willing to support it.

The bottom line is that a Biden win coupled with Democrats winning the Senate would mean taxes would go up. At this point, we don’t think they’d be raised fast enough or high enough to generate a recession by themselves. More likely, it means that after an early spurt of growth this year and perhaps next year, as the economy heals from the COVID-19 disaster, we’d be more likely to settle into a Plow Horse pace of economic growth (possibly with a hobbled hoof) like we had in 2009-16, rather than the somewhat faster pace of 2017-19.

However, more broadly, the election itself should not change how you and other investors approach the market throughout the rest of the year. Remember, one election does not make or break a nation. Hopefully, the U.S. receives a clear election outcome that allows markets to process the outcome and move forward. Before long, the 2022 mid-terms would loom large followed by the 2024 presidential election, with the American people ready to render electoral verdicts and make adjustments again and again.