Market Insights:

January 2, 2024

Posted on January 02, 2024

Planning and Guidance, Tailored To Your Life and Goals

Tuesday Takeaway

Posted on April 19, 2021

Where are Treasury bonds going?

The direction of bond yields is influenced by investors’ expectations for economic growth, among other factors. When economic growth is expected to weaken, bond yields tend to move lower. When economic growth is expected to strengthen, bond yields tend to move higher.

Last year, U.S. Treasury yields began to climb higher on optimism that vaccines, in tandem with fiscal and monetary stimulus, would strengthen economic growth. The yield on 10-year Treasuries rose more than 1 percent in just a few months, from 0.54 percent at the end of July 2020 to 1.75 percent at the end of March 2021.

Last week, Treasury yields moved lower. Ben Levisohn of Barron’s explained it’s “…possible that after yields nearly doubled to start the year, investors were simply waiting to see that the move higher was over before buying again. Of course, nearly everyone was predicting a 2 percent yield on the 10-year, while often forgetting that rarely does anything in financial markets move in a straight line.”

There are reasons for investors to be optimistic about what may be ahead and there may be reasons for concern:

There is trepidation about the effectiveness of mass vaccinations and the pace at which people in other regions of the world are being vaccinated, reported Chris Wilson of Time. In the United States, the pause in distribution of single shot vaccines caused some investors to be concerned, reported Hope King of Axios.

Other issues that may be weighing on investors include uncertainty about infrastructure spending and sanctions on Russia.

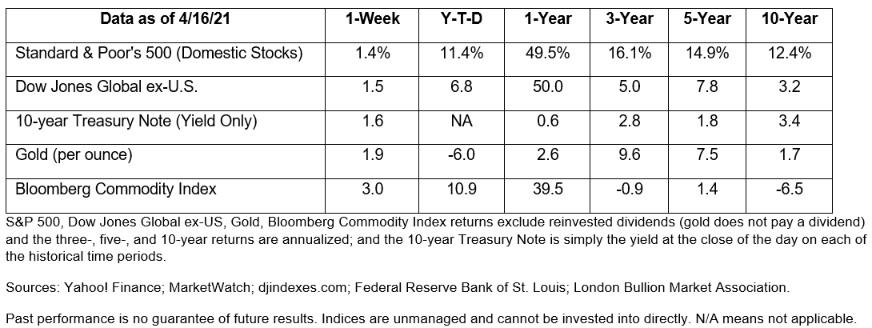

No one is ever certain what the future will bring. It’s one reason for having a well-diversified portfolio. (The one-year numbers in the scorecard below remain noteworthy. They reflect the strong recovery of U.S. stocks from last year’s coronavirus downturn to the present day.)

The impact of COVID-19 on workplaces has been profound. As we move toward a new normal, it is likely work as we once knew it will be changed forever. Employer benefits is one area in which there may be significant change.

Remote work options may be necessary for employers to remain competitive, according to the Pulse of the American Worker Survey:

“…a “war for talent” may be looming if companies don’t address workers’ needs…[the] war will be won by companies who affirm their standing as a top destination for both current and future talent. These employers will cultivate cultures that reflect what is most important to workers, such as remote-work options and flexible work arrangements, opportunities for career development and mobility, and comprehensive benefits that foster employee health and well-being and build financial resiliency.”

Financial wellness has become a top concern for Americans – at work and at home. Two-thirds of survey participants said they spent more time thinking about their finances in 2020 than they have in prior years, and they identified key barriers to financial security which included:

72% Lack of retirement savings

65% Lack of emergency savings

65% Not enough invested to grow

64% Too many bills

58% Not enough financial “know-how”

55% Too much debt

Some employers are considering new benefits that help address these issues, including emergency savings programs and other financial wellness options. If you have concerns about any of these issues, please get in touch.

You’ve probably heard lumber costs have increased over the last year, causing a $24,000+ increase in the average price of single-family homes since April of 2020. You might not know the details, though, of what caused lumber prices to be up nearly 260%.

The answer is supply and demand. Sawmills underestimated demand when the pandemic started, and so they limited their production by 30%. Turns out, though, that with everyone stuck at home in 2020, many turned to do-it-yourself home projects and spent 3% more on home upgrades than the prior year (while the US economy shrank 3.5% in 2020).

Also, because interest rates are still low as the economy is starting to turn around, new housing starts in the US hit a 14-year high in December of 2020.

Production of wood did ramp up and hit a 13-year high in February, but it’s still not enough to meet demand because of chinks in the supply chain caused by the pandemic. That has led ~70% of builders to raise home prices to slow down demand. Plus, the lumber industry is experiencing a labor shortage. When will we see easing in lumber prices? Maybe late 2021.

To learn more about the lumber industry’s multiple woes, including pine beetles and wildfires, read this Bloomberg article.