Market Insights:

January 2, 2024

Posted on January 02, 2024

Planning and Guidance, Tailored To Your Life and Goals

Tuesday Takeaway

Posted on March 30, 2021

Last week, unemployment claims were looking good and consumers were feeling good.

The number of Americans applying for first-time unemployment benefits declined. Just 684,000 people filed claims during the week of March 20, down 97,000 from the week before, according to last week’s report from the Labor Department.

Granted, that’s a large number – higher than the highest number of first-time claims during the Great Recession – but it’s the smallest we’ve seen since the pandemic began, according to Christopher Rugaber of the AP. He wrote:

“Economists are growing more optimistic that the pace of layoffs, which has been chronically high for a full year, is finally easing…Still, a total of 18.9 million people are continuing to collect jobless benefits…Roughly one-third of those recipients are in extended federal aid programs, which means they’ve been unemployed for at least six months.”

Consumer sentiment also improved, according to data released last week. The University of Michigan’s Index of Consumer Sentiment was up 10.5 percent month-to-month, although it remained down year-over-year. Perceptions of current economic conditions improved, too. Surveys of Consumers chief economist Richard Curtin reported:

“Consumer sentiment continued to rise in late March, reaching its highest level in a year due to the third disbursement of relief checks and better than anticipated vaccination progress…The majority of consumers reported hearing of recent gains in the national economy, mainly net job gains. The data clearly point toward robust increases in consumer spending. The ultimate strength and duration of the spending surge will depend on the rate of draw-downs in savings since consumers anticipate a slower pace of income growth.”

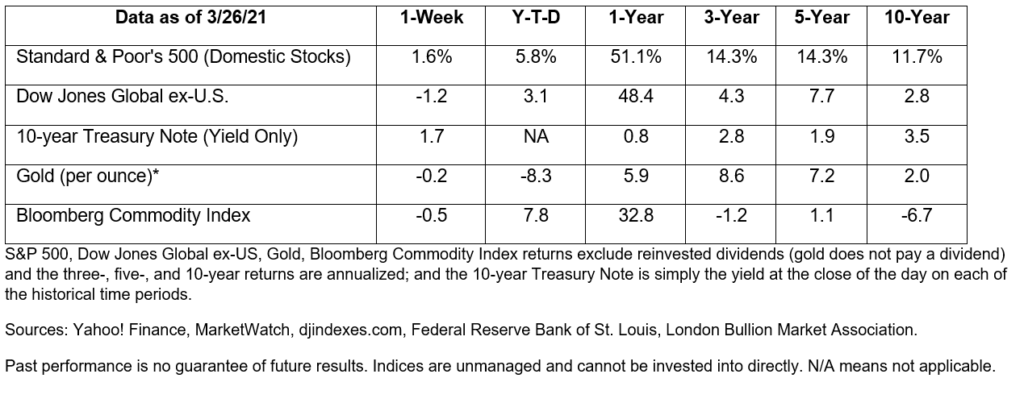

Performance of major U.S. stock indices was mixed last week. The Dow Jones Industrial Average and Standard & Poor’s 500 Index both finished higher for the week, while the Nasdaq Composite lost ground. (The one-year numbers in the scorecard are noteworthy. They reflect the strong recovery of U.S. stocks from last year’s coronavirus downturn to the present day.)

Until last week, about 50 vessels, transporting approximately 10 percent of global trade, sailed through the Suez Canal every day, reported Scott Neuman and Jackie Northam of NPR.

The canal is a shortcut that makes it possible for ships to travel from Asia and the Middle East to Europe without sailing all the way around Africa’s Cape of Good Hope, a route that’s both less secure (pirates) and more expensive (time, insurance, and fuel), according to David Sheppard, Harry Dempsey, Leo Lewis, and Kana Inagaki of Financial Times.

That changed on Tuesday when one of the largest container ships in the world became wedged in the canal, blocking traffic in both directions, reported Sudarsan Raghavan and Antonia Noori Farzan of The Washington Post.

The effect on global trade, supply chains, and consumers has yet to be determined. “Like much else about the situation, it depends on how long it goes on. A weeklong delay for a few hundred ships at the Suez might have only a negligible impact for consumers, but a prolonged delay could increase the cost of shipping, complicate manufacturing, and ultimately drive up prices,” reported NPR.

Prior to the shutdown at the Suez Canal, container shipping costs were already rising. The increase was due, in part, to a shortage of shipping containers. In early February, The Economist reported, “Surging demand for goods and a shortage of empty containers at Asian ports have sent container-shipping costs rocketing…The Freightos Baltic Index, a measure of container-freight rates in 12 important maritime lanes, has increased from $2,200 to $4,000 per container…” On Sunday, preparations were being made to unload some of the 18,000 containers the wedged ship carries to facilitate refloating, reported Yuliya Talmazan of NBC News.

Bald eagles are back! Thanks to conservation efforts, the number of bald eagles in the lower 48 U.S. states has quadrupled since 2009 and now counts at 300K+! Back in 2009, their number was thought to be ~72K.

Long held as a sacred species by Native Americans, as well as being the U.S. national symbol, eagles can dive at up to 99 mph and can have a wingspan of 7.5 feet. Read this NY Times article to learn more about how legislation and DDT led to the decline of eagles, and the efforts to bring them back.

Fun fact: The musical group The Eagles was originally formed in the early 70s as Linda Ronstadt’s band. But the group of musicians worked so well together, they decided to perform as their own group. Consequently, they never recorded with Ronstadt.