Market Insights:

January 2, 2024

Posted on January 02, 2024

Planning and Guidance, Tailored To Your Life and Goals

Tuesday Takeaway

Posted on May 10, 2021

Like a gender reveal gone wrong, last week’s employment report delivered an unexpected surprise.

Economists estimated 975,000 new jobs would be created in April. The United States Bureau of Labor Statistics (BLS) reported there were just 266,000. That’s a big miss.

Economists, analysts, and the media offered a wealth of theories to explain the shortfall. These included:

A former retail worker told Heather Long of The Washington Post, “The problem is we are not making enough money to make it worth it to go back to these jobs that are difficult and dirty and usually thankless. You’re getting yelled at and disrespected all day.”

Other data include the ADP® National Employment Report™ which showed 742,000 new jobs in April. The report reflects real-time data on one-fifth of U.S. private payroll employment.

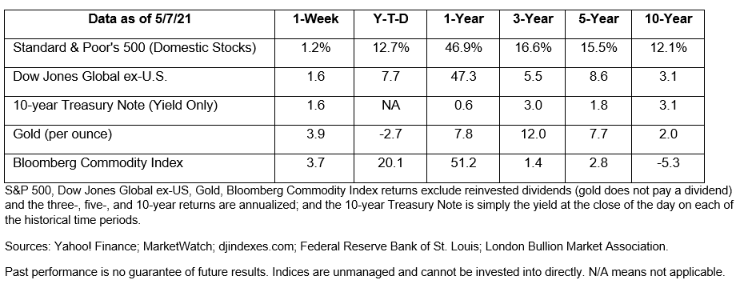

U.S. financial markets shrugged off the news. The Standard & Poor’s 500 Index finished the week at a record high, and 10-year Treasury rates finished Friday where they started. (The one-year numbers in the scorecard below remain noteworthy. They reflect the strong recovery of U.S. stocks from last year’s coronavirus downturn to the present day.)

There is a long-standing scientific theory about the size of a mammal’s body relative to its brain offers an indication of intelligence. The findings of a recent study seem to debunk that idea, reported Science Daily.

An international team of scientists investigated how the brain and body sizes of 1,400 living and extinct mammals evolved over time. They made several discoveries. One was significant changes in brain size happened after two cataclysmic events in Earth’s history: a mass extinction and a climatic transition.

Not every mammal changed in the same ways. Elephants increased body and brain size. Dolphins and humans decreased body size and increased brain size. California sea lions increased body size without comparable increases in brain size. All have high intelligence.

“We’ve overturned a long-standing dogma that relative brain size can be equivocated with intelligence…Sometimes, relatively big brains can be the end result of a gradual decrease in body size to suit a new habitat or way of moving – in other words, nothing to do with intelligence at all. Using relative brain size as a proxy for cognitive capacity must be set against an animal’s evolutionary history,” stated Kamran Safi, a research scientist at the Max Planck Institute of Animal Behavior and one of the study’s authors.

Of course, intelligence doesn’t always translate into wise behavior.

Studies of behavioral finance have found the human brain is more interested in survival than saving. “It turns out that, when it comes to money matters, we are wired to do it all wrong. Our brains have evolved over thousands of years to focus on short-term survival in a dangerous world with limited resources. They were not designed for today’s optimal financial behaviors,” wrote financial psychologist Dr. Brad Klontz, a CNBC contributor.

No one knows how the COVID-19 pandemic will be remembered over time, but it appears to have influenced the way people think about money in some significant ways. An April 2021 Bank of America survey reported:

If the pandemic has changed your thinking, let’s review your financial plan and align it with your current circumstances and thinking.

Swimply allows pool-less families to enjoy the experience of a private pool through renting. Sounds like a business idea that could sink or swim (and the investors from Shark Tank did not bite on the opportunity in 2020), yet the company is growing. When it started in 2018, Swimply booked ~400 reservations. Today, they book 15,000 – 20,000 reservations each month, with an average fee of $45/hour.

It all started when Swimply CEO Bunin Laskin, the oldest of 12 siblings, offered to help with the costs of keeping up his neighbor’s pool if the neighbor allowed his family to use the pool. In Swimply’s beginning, Laskin mapped homes with pools using Google Earth and literally went door to door to engage clients.

Swimply’s revenue grew 4000% last year, and their staff has grown from two to 20 employees, with plans to double to 40 in the near future. The company operates in 125 US markets, two in Canada, and five in Australia, and some pool owners make up to $10,000 a month renting out their pools.

And, if you’ve ever wanted to rent fun private spaces, like basketball courts or home theaters, those will soon be available through Swimply’s upcoming Joyspace.