Market Insights:

January 2, 2024

Posted on January 02, 2024

Planning and Guidance, Tailored To Your Life and Goals

Tuesday Takeaway

Posted on September 14, 2020

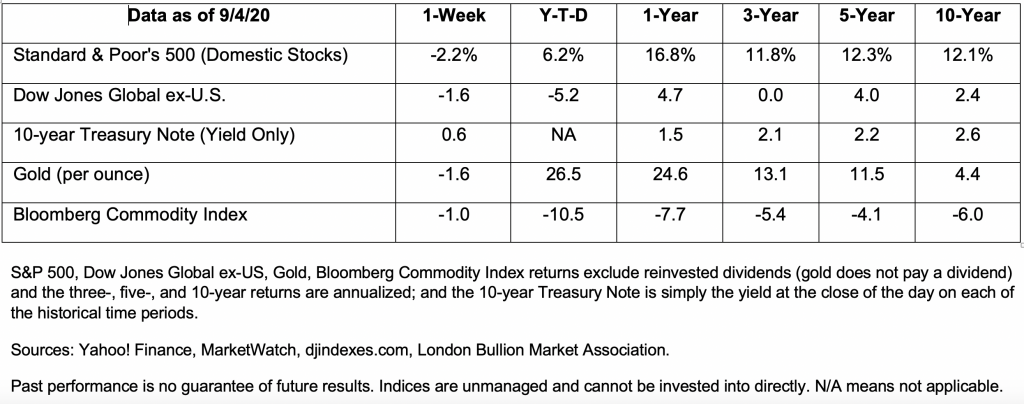

Stock markets in the United States retreated a bit last week.

U.S. stocks have been trending higher for months. Last week, they gave back some gains. The Nasdaq Composite dropped 3.3 percent, while the S&P 500 Index fell 2.3 percent, and the Dow lost 1.8 percent, reported Ben Levisohn of Barron’s.

It was difficult to pinpoint a specific reason for the market’s retreat. Levisohn offered a litany of possibilities that included:

The downturn could also have something to do with the Congressional Budget Office report on U.S. debt levels. Next year, our country is expected to owe more (government debt) than it produces (gross domestic product or GDP). By 2023, the U.S. debt-to-GDP ratio is estimated to be 107 percent, which would be the highest in our nation’s history.

A high debt-to-GDP level, typically, is bad news for economic growth. The World Bank has found countries with debt-to-GDP ratios that exceed 77 percent for extended periods of time, see significant slowdowns in economic growth, reported Will Kenton and Julius Mansa in Investopedia. U.S. debt-to-GDP has been above 77 percent since 2009, according to data from the St. Louis Federal Reserve.

Michael Mackenzie of Financial Times cautioned ultra-loose central bank monetary policy and enormous government spending can have unwelcome side effects. He cited an emerging markets strategist who argued, “…excessive stimulus and easy money policies led either to asset bubbles or a burst of inflation. Both outcomes ‘bode ill for share prices in the long run.’”

On the other hand, Mackenzie says, “Given the current U.S. policy mix that penalizes investors sitting on the sidelines and holding cash – given they are earning next to nothing in interest – any cooling of a red-hot market is easily framed as an opportunity. For many, it is another chance to ‘buy the dip.’”

We’ll see what happens next week.

COVID-19 has reshaped our world. Some of the ways we have adapted will be temporary, others may become permanent. Here are just a few ways our lives and the world around us have changed:

Next week, Walmart will launch their Walmart+ membership service that gives subscribers discounts on fuel, the ability to bypass checkout with their Scan & Go technology, and free same-day delivery (for orders of $35 or larger).

An article from The Spoon: https://thespoon.tech/walmart-to-launch-its-walmart-membership-service-on-september-15/?utm_source=Sailthru&utm_medium=email&utm_campaign=Amazon%20Jujitsu-email-4B&utm_term=4B explores how the new Walmart+ membership compares with Amazon’s Prime service. Most notably, Walmart doesn’t have streaming movies or music, but their same-day delivery, especially of groceries, is a much-needed service during the pandemic.

An Walmart+ annual membership costs $98/month, or customers can pay a monthly fee of $12.95.

Read the complete article here: https://thespoon.tech/walmart-to-launch-its-walmart-membership-service-on-september-15/?utm_source=Sailthru&utm_medium=email&utm_campaign=Amazon%20Jujitsu-email-4B&utm_term=4B