The Markets

Please don’t scream inside your heart.

Last week, a reopened Japanese theme park asked patrons to wear masks to help reduce the spread of coronavirus. It also asked them not to scream while riding the rollercoaster. “Please scream inside your heart,” park management urged.

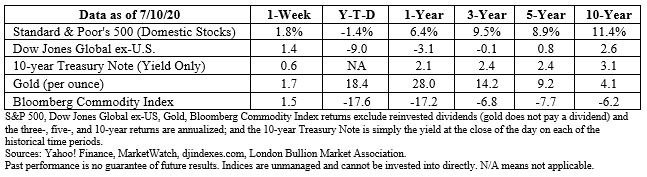

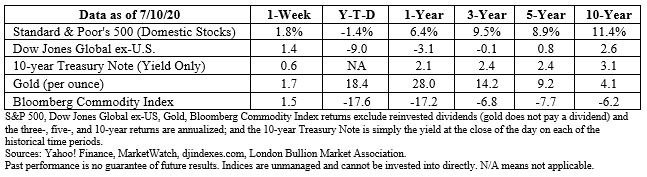

During 2020, stock markets in the United States have taken investors on an emotional rollercoaster ride. By late March, the Standard & Poor’s 500 Index had lost more than 30 percent. The Index has since regained most of those losses, although there have been many ups and downs along the way.

The culprits behind market volatility have been fear and uncertainty, often inspired by twists and turns in the coronavirus saga. Last week, as stocks faltered and demand for U.S. government bonds surged, Eric Platt and Colby Smith of Financial Times reported:

“The strong demand for [safe] haven assets emerged after several U.S. states reported further increases in coronavirus cases, after Florida on Thursday recorded its largest death toll since the crisis spread to the United States. Some succor was provided to nervous investors on Friday after [a pharmaceutical company] released data showing its potential coronavirus treatment…had reduced mortality rates in early trials. That provided a bump to stocks and tempered the gains in Treasuries.”

Volatile markets often cause investors to become uneasy. Sometimes, the emotional rollercoaster causes them to focus on short-term performance rather than long-term financial goals. Today, market fluctuations, in tandem with health concerns, work anxiety, and social distancing requirements, may trigger a stronger response than usual, making investors particularly vulnerable to the emotional biases within us.

If short-term market swings are making you restless or uncomfortable, don’t keep it to yourself. This is a good time to re-evaluate your risk tolerance, review your financial goals, and make sure you have enough cash to meet current needs.

The Coronavirus Effect

COVID-19 has been reshaping Americans’ financial habits. During the second quarter, credit card debt and personal savings data showed, overall, we were spending less and saving more than ever before.

In 2019, when a pandemic was a planning and preparedness exercise for epidemiologists, healthcare professionals, and health officials, the debt Americans accrued on credit cards increased between 2.5 and 4.6 percent each quarter.

Since COVID-19 arrived on our shores and began to spread, credit card debt has fallen dramatically. From January through March, it was down 7.6 percent (the seasonally adjusted annual rate). In early July, the

Federal Reserve reported the numbers through May:

- April 2020: – 64.8 percent (seasonally adj. annual rate)

- May 2020: – 28.6 percent (seasonally adj. annual rate)

Lower spending may have contributed to higher savings. The personal saving rate (PSR) in the United States is the percentage of income left after people spend money and pay taxes each month. It increased dramatically in 2020:

- January 2020: 7.9 percent (seasonally adj. annual rate)

- February 2020: 8.4 percent (seasonally adj. annual rate)

- March 2020: 12.6 percent (seasonally adj. annual rate)

- April 2020: 32.2 percent (seasonally adj. annual rate)

- May 2020: 23.2 percent (seasonally adj. annual rate)

Some believe higher rates of saving are the result of lockdowns and will reverse quickly as states reopen. An analyst cited by Jessica Dickler of

CNBC explained, “In a month with large government stimulus payments to the majority of U.S. households and widespread economic shutdowns that largely curtailed discretionary spending, the boost to income and the plunge in spending produced an outsized savings rate.”

The shift in percentages from April to May appear to support the hypothesis. We won’t really know whether Americans will continue to charge less and save more until the pandemic ends.

Future Returns: An Actuarial Take on Post-Covid-19 Investing

Ever consider how your portfolio should look after COVID-19? And what factors might influence how and where you invest?

Author Rob Csernyik wrote a Barron’s article titled, “Future Returns: An Actuarial Take on Post-COVID-19 Investing” that looks at how countries responded to the pandemic to determine if their economic recovery might match their handling of the virus.

https://www.barrons.com/articles/future-returns-an-actuarial-take-on-post-covid-19-investing-01592933899

Actuarial Paul Sandhu takes some cues from how markets recovered in the ten years following the 2008 financial crisis to discuss potential outcomes from the virus, and he offers three suggestions for portfolio management post-COVID-19:

- Use COVID-19 as a Diversification Barometer

- Use Volatility to Generate Alpha Opportunities

- Don’t Worry About Timing the Market’s Bottom

Read the complete article here: https://www.barrons.com/articles/future-returns-an-actuarial-take-on-post-covid-19-investing-01592933899

]]>

]]>

]]>