The Markets

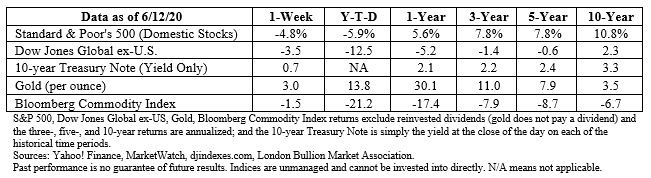

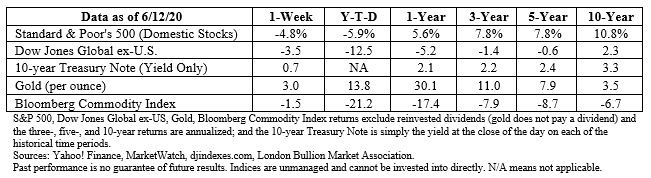

The Nasdaq Composite dipped its toes into record territory last week before retreating.

Stock indices in the United States rallied early last week on optimism about the reopening of businesses across the country. The Nasdaq Composite rose to 10,000 for the first time ever, before tumbling lower.

Nicholas Jasinski of Barron’s reported, “What caused the rally to sputter this past week? Nothing particularly new or unexpected. On Wednesday, Federal Reserve Chairman Jerome Powell emphasized the long, slow path back to previous levels of employment and economic activity, in contrast to the market’s lightning-fast recovery. Shocking.”

On Wednesday, the United States Federal Reserve (Fed) economic projections showed U.S. economic growth declining 6.5 percent this year with unemployment receding to 9.3 percent. In 2021, the Fed expects economic growth to improve, increasing by 5 percent, while unemployment ebbs to 6.5 percent.

Fed Chair Jerome Powell said:

“The extent of the downturn and the pace of recovery remain extraordinarily uncertain and will depend in large part on our success in containing the virus. We all want to get back to normal, but a full recovery is unlikely to occur until people are confident that it is safe to reengage in a broad range of activities. The severity of the downturn will also depend on the policy actions taken at all levels of government to provide relief and to support the recovery when the public health crisis passes.”

Powell indicated low income workers have been hit hardest in this recession and Congress may need to take additional action to help improve the labor situation in the United States.

News that the number of confirmed coronavirus cases had risen in several U.S. states, as well as other countries, coupled with the Fed’s modest outlook for the pace of recovery, appeared to kindle investor anxiety and U.S. stocks sold off sharply on Thursday.

By Friday, major indices had recouped some losses, but finished lower for the week.

How Does Volatility Impact Your Choices?

When it comes to investing, people tend to have short memories. During bull markets, as stock values push higher, many investors want to increase their exposure to stocks. Why wouldn’t they? When volatility is relatively low, it can be difficult for investors to recall why they limited their exposure to higher risk assets.

Similarly, when a bear market arrives and volatility increases, investors often want to retreat to the safety of more conservative investments. After all, when volatility increases and stock values fluctuate dramatically, it can be difficult for investors to recall why they chose to invest any portion of their portfolios in stocks.

The fact is, investors often fall prey to a phenomenon known as recency bias. People tend to believe what is happening now will continue to occur in the future. It won’t. The economy tends to cycle from expansion to contraction and back to expansion. Stock markets tend to cycle from bull markets to bear markets and back to bull markets. Periods of high volatility tend to be followed by periods of low volatility.

We are all susceptible to recency bias and other behaviors that can undermine investment success. In their research paper, The

Behavior of Individual Investors, Brad Barber and Terrance Odean concluded:

“The investors who inhabit the real world and those who populate academic models are distant cousins. In theory, investors hold well diversified portfolios and trade infrequently so as to minimize taxes and other investment costs. In practice, investors behave differently. They trade frequently and have perverse stock selection ability, incurring unnecessary investment costs and return losses. They tend to sell their winners and hold their losers, generating unnecessary tax liabilities. Many hold poorly diversified portfolios, resulting in unnecessarily high levels of diversifiable risk, and many are unduly influenced by media and past experience.”

If recent volatility has caused you to question your investment choices, please get in touch. Together we’ll review your goals, strategy, and portfolio allocation and suggest recommendations which support your goals and risk tolerance.

A Low-Salt Diet Could Improve Your Health

A Low-Salt Diet Could Improve Your Health

Salt helps make many dishes taste delicious. However, it comes with an unwelcome side effect; it can raise blood pressure and stress the circulatory system, increasing the risk of heart disease or stroke.

Research suggests people with high blood pressure benefit from low-salt diets, and there may be benefits for people with normal blood pressure, too. The

American Heart Association recommends limiting yourself to 1,500 mg of salt a day is ideal.

1, 2

Harvard Medical School offered some tips for reducing salt intake. They include:

- Pass on bread and rolls, which often have high levels of sodium.

- Make your own pizza, at home, with low-salt ingredients.

- Choose homemade soup rather than canned, unless you buy low-sodium options.

- Stick with lower-sodium cheeses. Feta and blue cheese are typically quite salty, while goat cheese and ricotta are not.

One way to manage the risk when ordering from restaurants is to review their online nutrition information.

]]>

A Low-Salt Diet Could Improve Your Health

A Low-Salt Diet Could Improve Your Health ]]>

]]>