Market Insights:

January 2, 2024

Posted on January 02, 2024

Planning and Guidance, Tailored To Your Life and Goals

Tuesday Takeaway

Posted on June 09, 2020

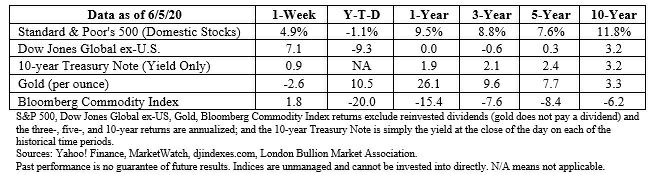

The Markets The employment report electrified U.S. stock markets last week. American stock markets responded enthusiastically to the news U.S. unemployment was 13.3 percent in May. If it seems inexplicable double-digit unemployment would thrill investors, there is a reason. The unemployment rate in April was higher at 14.7 percent, and analysts had forecast the rate in May wouldjump to 19.1 percent. All in all, that makes 13.3 percent look pretty attractive. There were some caveats. First, “If the workers who were recorded as employed but absent from work due to ‘other reasons’… had been classified as unemployed on temporary layoff, theoverall unemployment rate would have been about 3 percentage points higher than reported,” explained the Bureau of Labor Statistics (BLS). The same would have been true of April’s numbers, so it’s a wash. Month-to-month, the numbers dropped. Second, there is more than one measure of unemployment. U3 measures people who are unemployed and seeking work. U6 includes unemployed, underemployed (part-time workers who want to be working full- time), and discouraged workers. It’s usually a higher number. The May Employment Summary Report showed U6 unemployment was 21.2 percent, down from 22.8 percent in April. That suggests about one-in- five Americans is not working asmuch as they would like to be. The BLS wrote the improvement in unemployment reflected, “…a limited resumption of economic activity that had been curtailed in March and April due to the coronavirus (COVID-19) pandemic and efforts to contain it.” The biggest job gains were in leisure and hospitality, construction, education and health services, and retail trade. The lower month-to-month numbers may be a sign the Paycheck Protection Program (PPP) worked:

“…give some credit to the government relief efforts, especially the [PPP], for bringing back jobs. The program gave relief to small businesses…through loansthat would not have to be paid back if most of the money went to rehire and pay employees. PPP money had to be used right away, and a lot of it startedhitting small businesses’ bank accounts in late April and early May, which ended up triggering a net gain of 2.5 million jobs in May,” reported Heather Long ofThe Washington Post.Eurozone stocks rallied last week, too, after the European Central Bank increased its quantitative easing program and extended support to June 2021, reportedDhara Ranasinghe and Yoruk Bahceli of Reuters. Major U.S. indices and U.S. Treasury yields finished the week higher.

]]>

]]>