Market Insights:

January 2, 2024

Posted on January 02, 2024

Planning and Guidance, Tailored To Your Life and Goals

Tuesday Takeaway

Posted on March 18, 2019

Stock and Bond Markets Rallied

Last week, major U.S. stock indices finished higher for the 10th time in 12 weeks. Bond markets moved higher, too, with the yield on 10-year Treasuries dropping just below 2.6 percent, reported Randall Forsyth of Barron’s. Yields on 10-year Treasuries haven’t been this low since January 2018.

The simultaneous rallies are curious because improving share prices are often an indication of a strong or strengthening economy. Improving bond prices tend to be a sign of weakening economic growth, reported Michael Santoli of CNBC.

Why are U.S. stock and bond markets telling different stories?

It may have something to do with investor uncertainty. A lot of important issues remain unsettled. The British government appears incapable of resolving Brexit issues, the United States and China have not yet reached a trade agreement, and recent economic reports have caused investors to take a hard look at the U.S. economy.

Barron’s pointed out investors appear to be hedging their bets by favoring in utilities and other stocks that have bond-like characteristics and participate in the stock market’s gains. An investment strategist cited by Barron’s explained:

“The strength in utilities reflects the attitude of investors who ‘don’t really buy the rally’…While they’re skittish, they still want to participate in the stock market rally but opt for its most conservative sector.”

We’ve seen this before with stocks and bonds, according to a financial strategist cited by Patti Domm of CNBC. “It’s a little bit of a funky correlation. We’ve had both things rallying, which is strange. This is what happened in 2017, when all asset classes did well. In 2018, nothing did well…I would suspect it goes away soon.”

Times like these illustrate the importance of having a well-diversified portfolio.

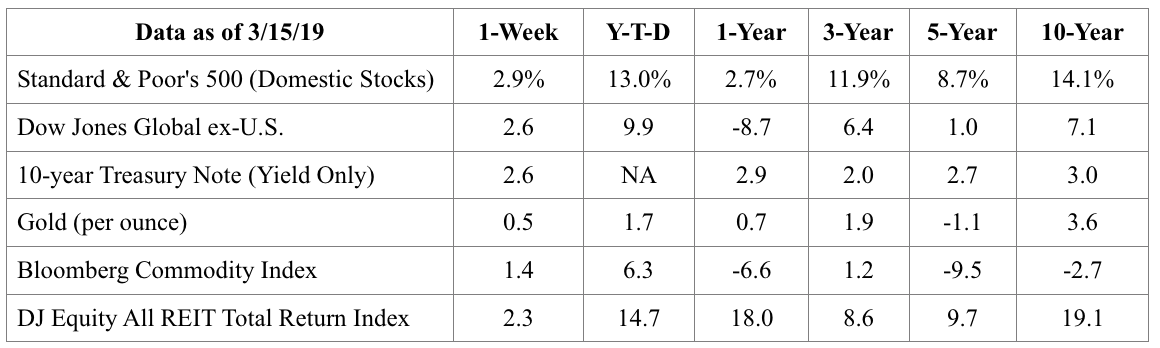

[caption id="attachment_2788" align="aligncenter" width="1160"] S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods. Sources: Yahoo! Finance, MarketWatch, djindexes.com, London Bullion Market Association.

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods. Sources: Yahoo! Finance, MarketWatch, djindexes.com, London Bullion Market Association.The 2018 Insights on Wealth and Worth survey provided some startling information about the priorities of high net worth (HNW) investors. More than one-half (54 percent) indicated long-term capital appreciation was a higher priority than income generation. The other 46 percent were looking for steady income.

Let’s look at the percentages by age group:

Millennials (ages 21 to 37), Gen Xers (ages 38 to 53), and Baby Boomers (ages 54 to 72) prioritize steady long-term income to the same extent.

Older investors, who are near or are in retirement, tend to emphasize steady long-term income because they need to maintain their standard of living in retirement. However, one of the advantages of youth is these investors have the time and flexibility to take on higher levels of risk and recover from any market downturns. In other words, younger investors prioritize capital appreciation (i.e., growth) while older investors prioritize income.

It’s important for younger investors to consider their life goals and how their finances may support the pursuit of those goals.

“There are risks and costs to action. But they are far less than the long range risks of comfortable inaction.”

–John F. Kennedy, 35th President of the United States

]]>