Are You Ready to File Your 2021 Federal Tax Return?

Posted on April 07, 2022

Planning and Guidance, Tailored To Your Life and Goals

News

Posted on July 14, 2021

Since the start of 2021, global equities have advanced 11% and aggregate 10-year government bond yields have moved 40 basis points (bps) higher. High frequency data suggest that economic activity is surging, aggregate household balance sheets are in good health, and economic output in developed markets is expected to surpass pre-pandemic levels by Q3 2021.

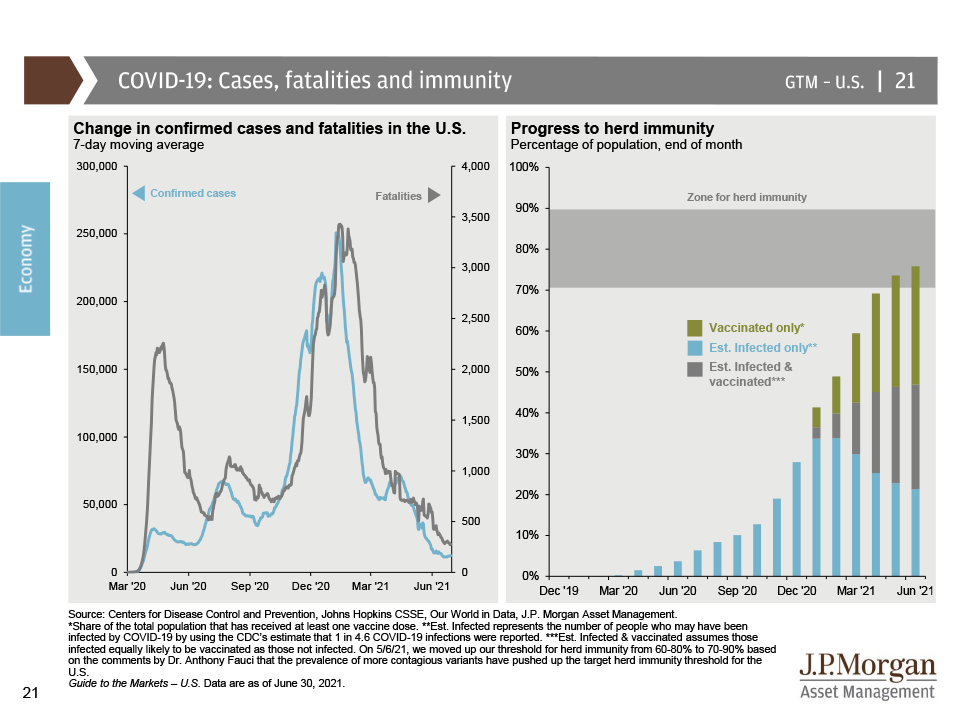

The U.S. has made considerable progress on managing the spread of the pandemic. After surging in the winter months, the U.S. has seen new cases and fatalities falling dramatically as vaccinations continue. This begs the question: where are we on the road to herd immunity? The below chart shows the total share of the population vaccinated and those who have already had the virus. However, as the pace of inoculations has slowed and new strains of the Covid-19 virus have emerged, the U.S. needs to make further progress. Nonetheless, growing immunity, better testing and the potential for booster shots should allow the number of cases and fatalities to remain depressed, allowing life largely to return to normal.

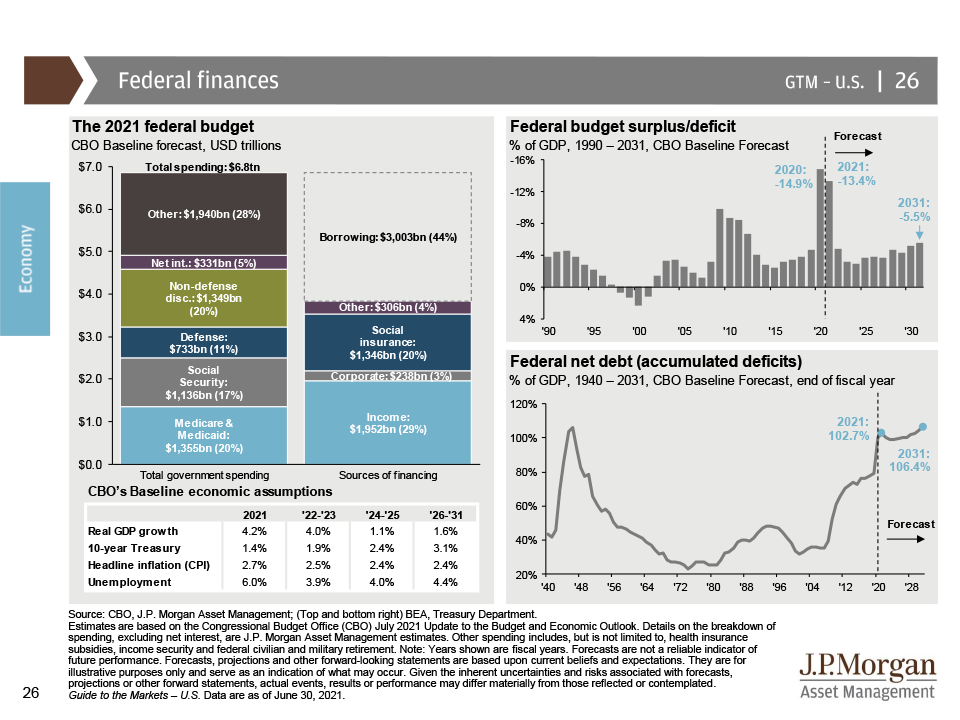

The federal government is on track to hit a new record high debt-to-GDP ratio by the end of fiscal 2021, even higher than in the aftermath of World War II. The $1.9 trillion American Rescue Plan is still working itself through the system and will continue to support the economy through the end of the year and into 2022. Washington has also proposed $4.2 trillion in additional spending aimed at infrastructure, child care and education, among other initiatives. Investors should recognize that if the government fails to rein in deficits and debt monetization as the economy accelerates in a post-pandemic world, the risk of a boom-bust recession will grow. In particular, a sharp rise in inflation could result in higher interest rates and higher taxes, and could ultimately set the stage for an economic relapse.

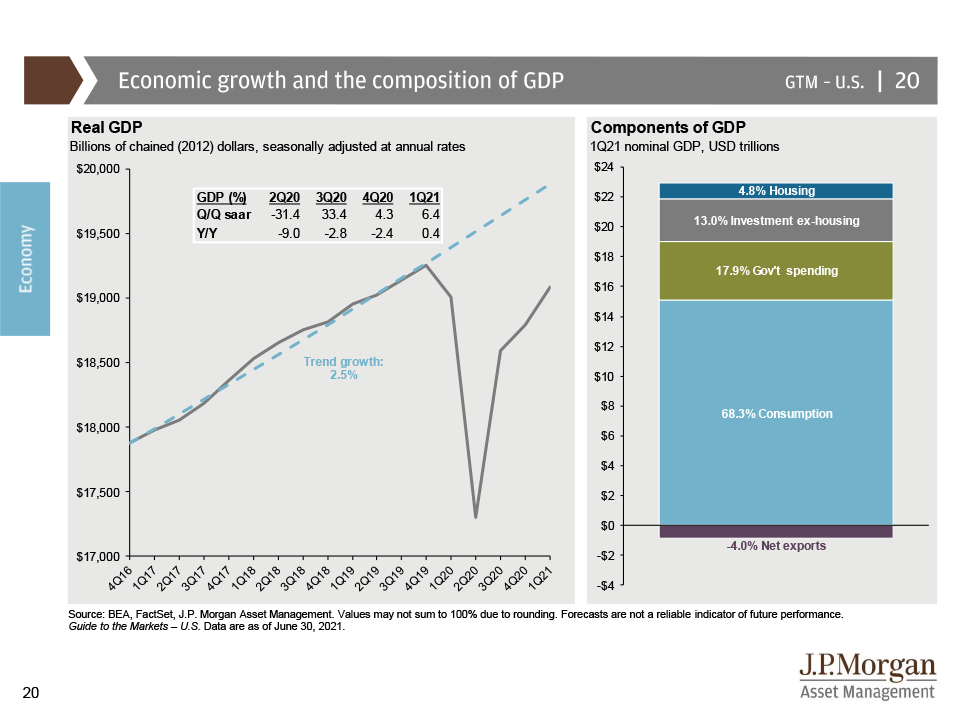

Following a collapse in the Q2 2020, economic growth surged in Q3 2020, moderated over the winter and has now reaccelerated, tracking above 10% annualized real GDP growth for Q2 2021. Blockbuster consumer spending on goods, a resurgence of spending on services and rebounding investment spending could push the economy to a full GDP recovery by this quarter. It’s important to maintain a sense of perspective. While global output is now back to pre-pandemic levels, it’s still 3% lower than it would have been without the hit from COVID-19. This gap should narrow over the coming year, but we doubt that growth will be strong enough to close it altogether. We expect growth to then fade over the course of the expansion, returning to the roughly 2% pace it saw at the end of the last long economic cycle.

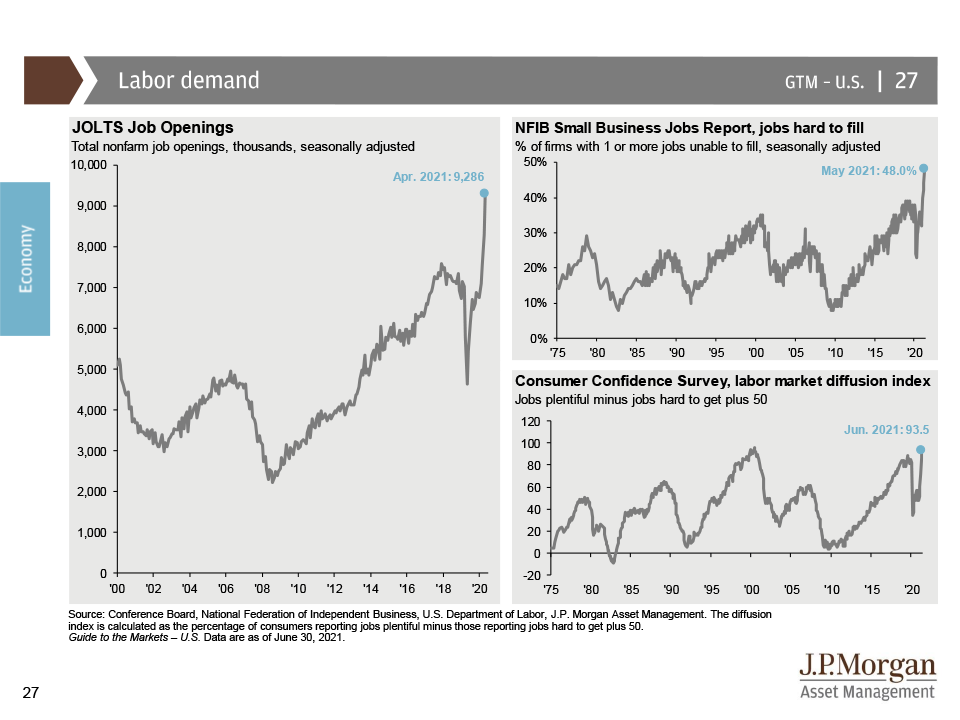

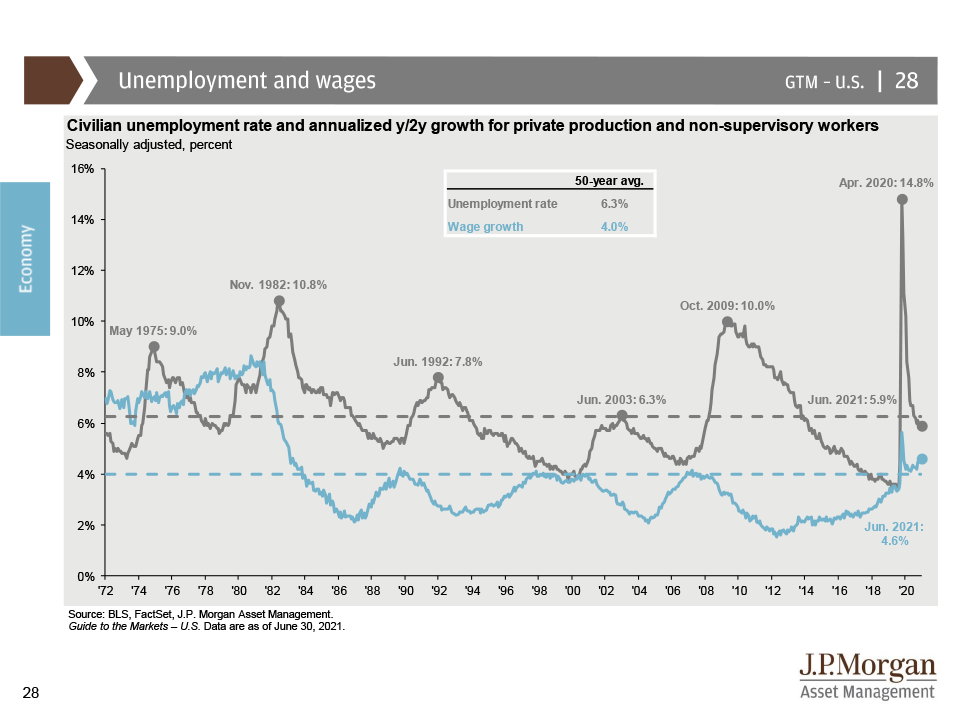

While the recovery in the labor market thus far is encouraging, an elevated unemployment rate suggests it is still far from complete. Reports from businesses suggest that labor demand is exceptionally high as businesses grapple to keep up with pent-up consumer demand. This slide shows the steep rise in both the number of small business owners reporting difficulty in filling job postings and in JOLTS nonfarm job openings. This mismatch of record-high job vacancies and elevated unemployment highlights that the shortcoming in job creation is really an issue of labor supply. Prolonged enhanced unemployment benefits, lingering pandemic worries, childcare responsibilities, and early retirements have likely restrained labor supply. However, many of these pandemic effects should recede over the course of the year and should allow the unemployment rate to fall further.

With surging labor demand and a higher cost of low-wage labor due to enhanced unemployment benefits, employers have had to raise wages to lure people back to work. The below slide shows that as unemployment has fallen, wage growth has been rising and is above historical trends. We’ve updated this slide to show annualized year-over-two year growth in wages to remove the base effects from last year when wage growth shot up due to the concentration of job losses in low-wage sectors. This is critically important for the Federal Reserve, as higher wages could lead to inflation that is less “transitory” than the Fed currently expects.

The question, perhaps, might be why the Federal Reserve (Fed) has not been even more anxious to withdraw monetary stimulus than the somewhat hawkish tone at the June policy meeting implied. The answer lies in the high level of unemployment that has persisted since the pandemic lockdowns. True, economic reopening will mop up labor slack quickly. But getting people back to work and reinforcing the recovery remain policymakers’ principal goals today.

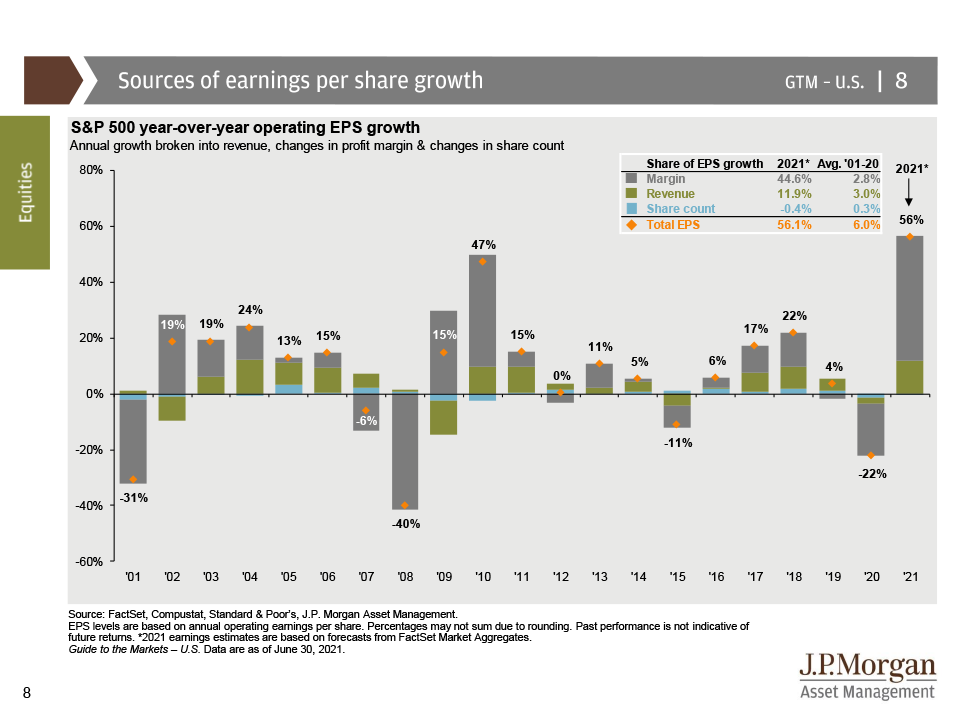

Earnings have recovered spectacularly since the big declines in early 2020 and are now expected to hit a new all-time high in 2021. This reflects both the relatively solid profits in sectors like technology and health care throughout the pandemic, but also a rebound in many of the cyclical sectors that struggled the most last year. However, from 2022 on, slower economic growth, higher wage costs, higher interest rates and, potentially, higher corporate taxes could make further profit gains much more difficult to achieve.

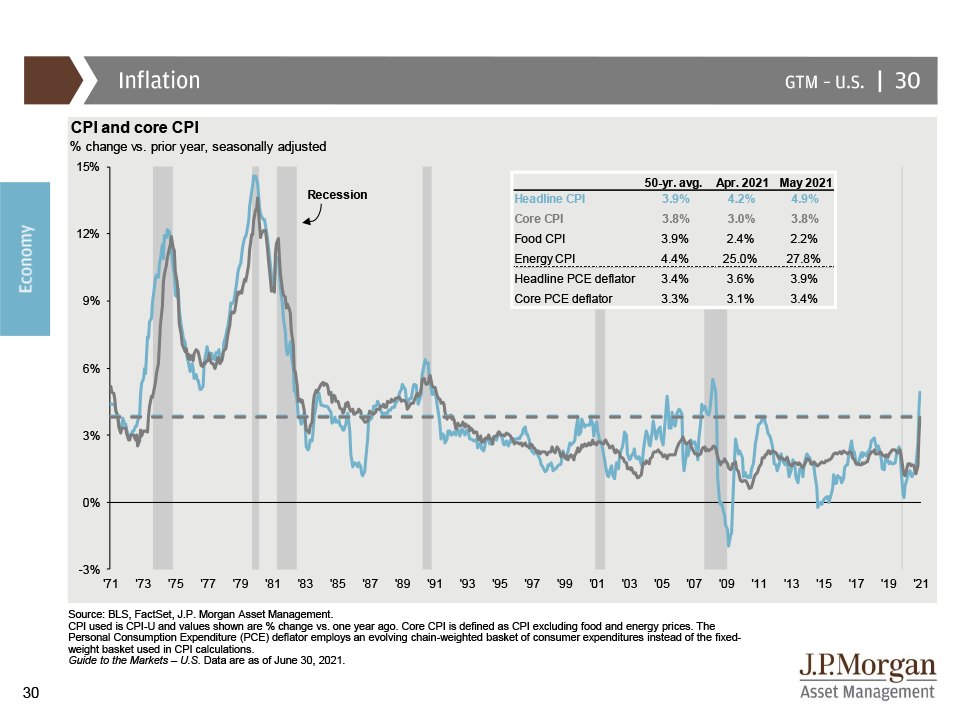

The onset of the pandemic recession, combined with a collapse in oil prices, triggered a decline in already low inflation in 2020. Since then, inflation signals have heated up significantly as a surge in consumer spending collided with supply shortages across major sectors of the economy. We expect rising inflation will continue to be an issue in the second half of this year. While some price increases are slowing for goods like lumber and used cars, others remain high. We expect inflation to ease further into 2022 after unemployment benefits expire and wage pressures normalize. The Fed is likely to take a gradual approach to tapering and raising interest rates. Meanwhile, the Fed has been consistent in their message that they regard near-term spikes in inflation as transitory. However, after years of dormant inflation, a powerful economic rebound coupled with rising wages could put the Fed’s new framework to the test.

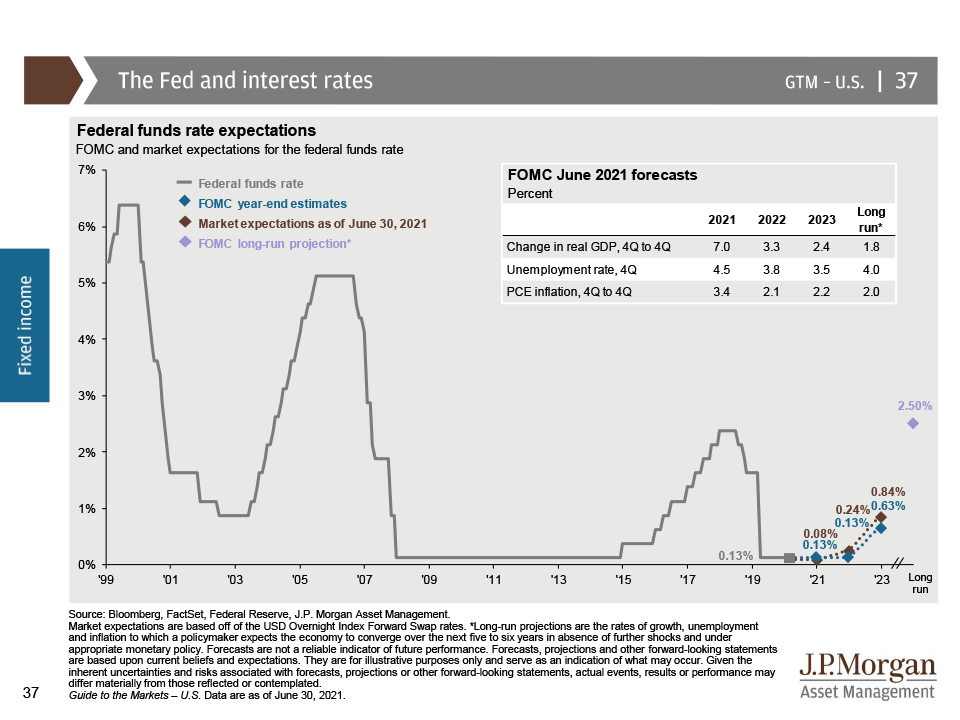

In the first half of 2020, the Federal Reserve took very strong action to support the economy including cutting the federal funds rate to a range of 0-0.25%, opening or expanding a very wide range of facilities designed to support different parts of the bond market and adding dramatically to its balance sheet. In addition, the Fed adopted an “Average Inflation Targeting” strategy, by which they will aim to achieve inflation of above 2% for some time to make up for years of undershooting this target.

At its June meeting, the Fed delivered meaningful upgrades to its forward guidance by way of its updated growth and inflation projections. Along with its more optimistic outlook on the economy, the committee has also shifted to a slightly more hawkish stance. The median dot plot for June reflects two rate hikes sometime in 2023, up from no rate hikes in March and the Fed is now discussing a timetable for tapering its bond purchases.

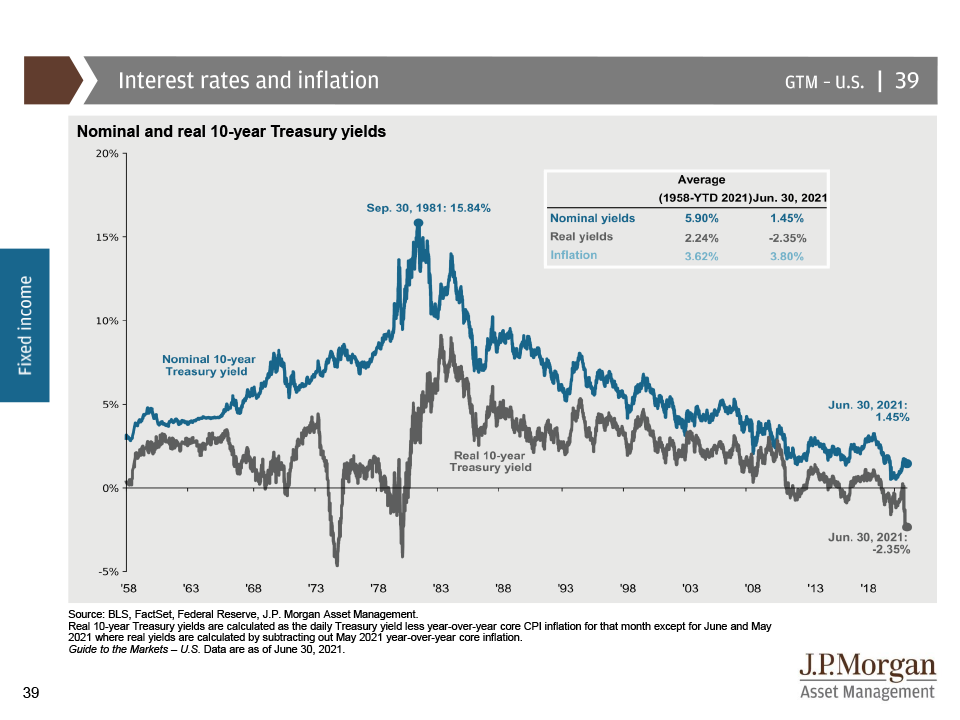

The combination of very easy monetary policy and a recession has left 10-year Treasury yields very low. Interest rates will likely move higher over the course of the year, against the backdrop of rising inflation, faster growth, and the signaling of a less accommodative Fed as they discuss tapering. There continues to be a place in portfolios for fixed income to provide diversification and protection in the case of an equity market or economic relapse, but investors may want to focus on shorter duration bonds to be well-positioned if long-term rates resume their ascent.

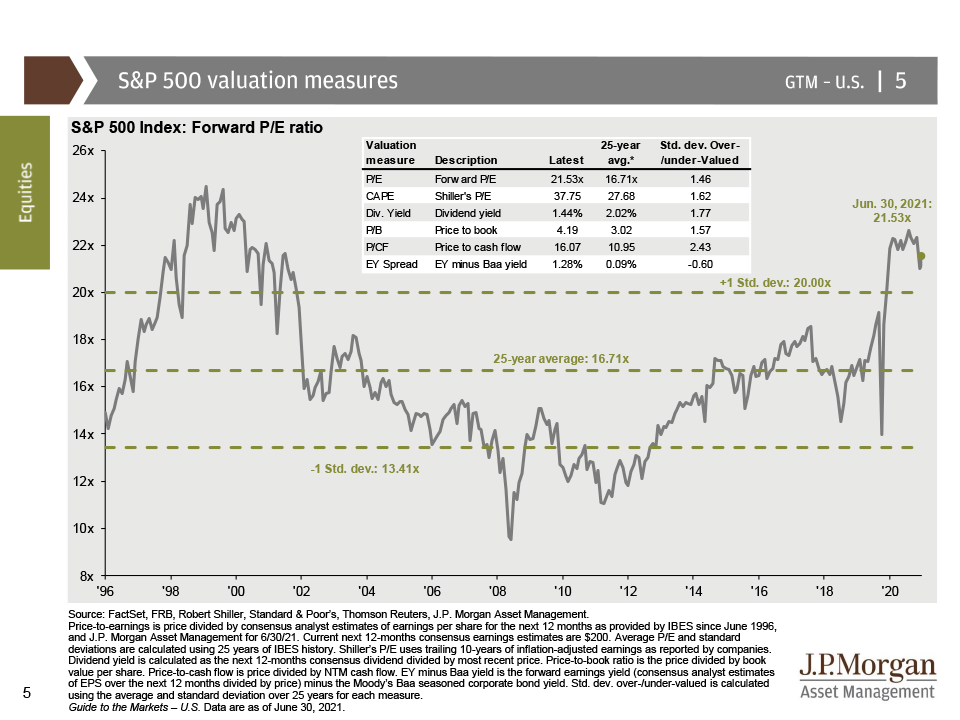

U.S. equities have trended higher during the first half of the year, characterized by range-bound valuations and rising earnings estimates. Stock prices based on current forward P/E ratios still look elevated, although they have come in somewhat as earnings have played catch-up. Earnings are likely to continue to grow quickly in the remainder of the year, which could lead to further compression in these ratios. Relatively low interest rates likely justify some elevation of valuation measures above their historical averages. However, higher inflation, corporate taxes, and wage pressures will likely put further pressure on equity valuations within the next few years.

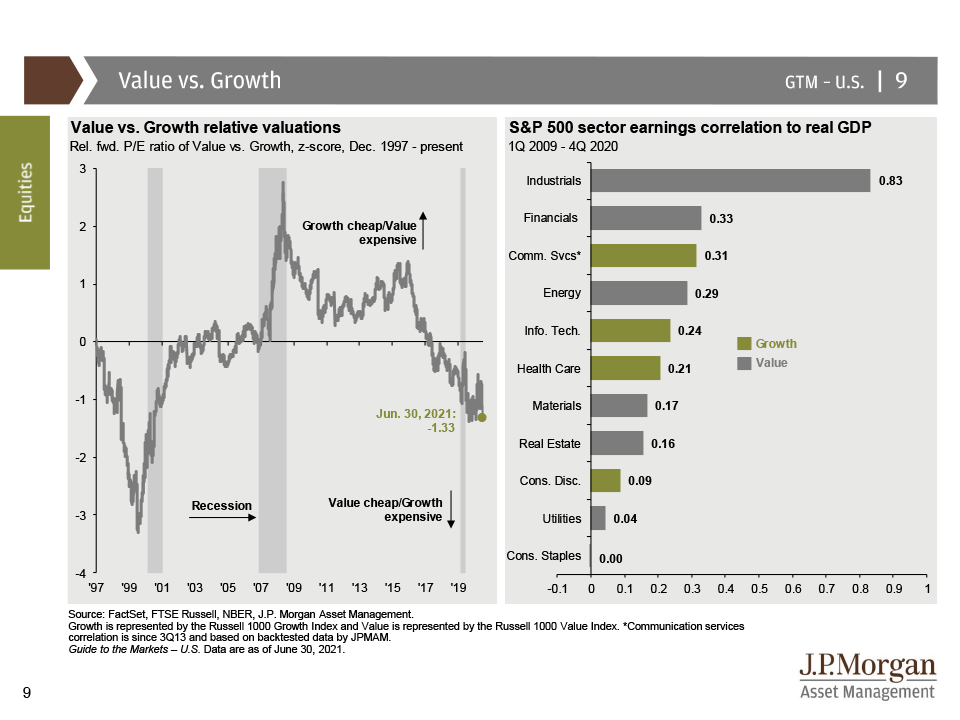

After multiple years of strong outperformance of growth stocks, most notably during the pandemic in 2020, value has begun to recover. The below chart shows that even after a good start to 2021, value appears to remain cheap relative to growth compared to long-term averages. Additionally, value generally tends to outperform growth during periods of above-trend economic activity and rising interest rates.

However, investors would be wise not to abandon growth stocks altogether as the economy is likely to slow down to a much slower pace of economic growth later in 2022 and into 2023, and growth stocks have traditionally outperformed value stocks in a slow economic growth environment. In our view, the fundamental drivers of quality growth companies remain intact. Structural themes, such as e-commerce penetration, cash-to-card migration, and premiumization in consumer discretionary, should persist as the recovery continues. Quality growth stocks can also benefit from cyclical tailwinds. For example, companies like Google with online travel advertising, which is still weak, and Mastercard, with roughly one third of its earnings related to cross-border travel, could benefit from a strong rebound in travel in 2022.

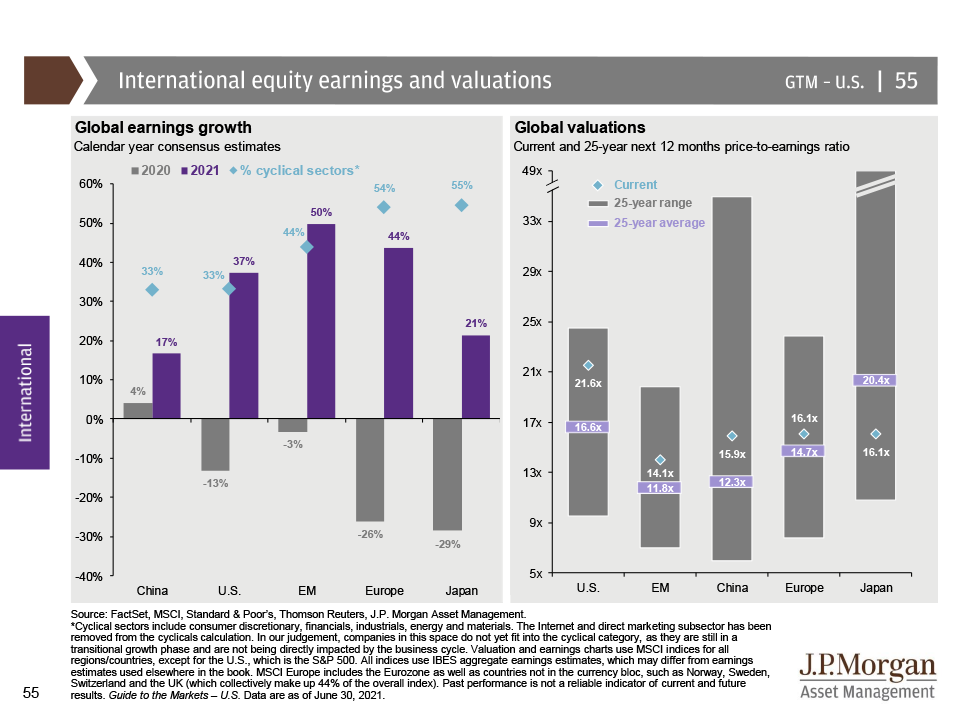

While the expected synchronized global recovery has been delayed, it has not been derailed, and vaccination progress is now gaining speed globally. Europe in particular has seen a substantial improvement in vaccinations and upcoming fiscal support from the EU Fiscal Recovery Fund should benefit the region.

In addition, both emerging market and developed market stocks are at some of their cheapest levels relative to the U.S. in the last 20 years. This, along with a powerful global post-pandemic economic rebound, lower trade tensions and the prospect of a lower dollar in the long run all argue for a greater allocation to international equities, with a particular focus on East Asia and Europe.

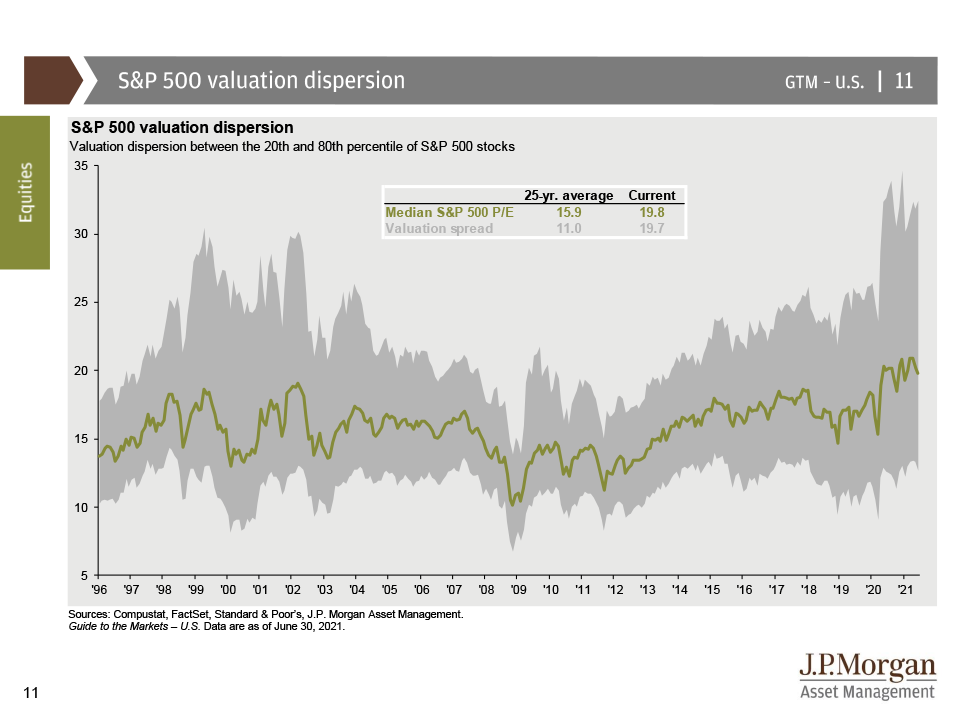

This below chart shows the S&P valuation dispersion over the last 25 years, illustrating that with strong performance comes the challenge of higher valuations. The current S&P 500 valuation spread is markedly higher than the 25-year average – this wide dispersion in valuations points to an opportunity for active management.

The U.S. economy is looking healthy as we enter the third quarter, and continued progress on the pandemic at home and abroad will be vital in keeping the pace of the global economic recovery. Given the substantial progress markets have made in recovery, investors would be wise to focus on fundamentals and maintain a somewhat diversified stance, taking advantage of active management as we enter a new era in the post-pandemic world.

As the reopening trend spreads out from the U.S., we expect to see a prolonged period of above-trend global growth. Although economic indicators in the U.S. point to mid cycle, in Europe and Japan economies still appear to be in the early phase of the cycle. With capex strong and consumers poised to unleash meaningful pent-up demand — likely to be directed more toward the services side of the economy — we expect above trend global growth to persist well into 2022. This will in turn lend solid support to corporate earnings.

Base effects, supply-chain disruption and the impact of fiscal stimulus have combined to push inflation higher, notably in the U.S. As we move toward autumn, we expect inflation to ease but upside risks to persist. Importantly, the Fed’s marginally hawkish tone suggests that higher rates — when they materialize — will from here be led by rising real rates rather than further advances in inflation breakevens.

With the extremes of policy accommodation likely behind us, the global economic backdrop has slightly changed, taking on a more mid-cycle feel. Nevertheless, the surge of reopening activity and already-ample liquidity support a risk-on tilt in portfolios. We continue to overweight equities with fairly high conviction and underweight cash with moderate conviction. We also overweight credit, but at the margin we are reducing exposure, given tight spreads. And while we retain an underweight in duration, our conviction level is low, given central bank bond purchases.

Within equities, we keep our preference for cyclical markets in Europe and Japan, and at the margin have trimmed our tilt toward value-style stocks. While the value factor remains attractive relative to the growth factor, we are inclined to also focus a little more on the quality factor as we move into mid cycle. This leads us to reevaluate U.S. equities, where we believe quality of earnings and a renewed focus on secular growth themes may provide support in the latter half of the year.

In fixed income, our duration underweights are concentrated in U.S. Treasuries, and our credit overweight continues to be expressed in U.S. high yield and crossover credit — albeit with lighter exposures. We continue to expect higher sovereign yields over the remainder of 2021 but see a much reduced risk of a disorderly bond market sell-off.

Above all, we look increasingly to diversify equity exposure across a range of markets, in keeping with the broadening of global growth. Corporate earnings failing to come through, unjustified policy tightening and new vaccine-resistant strains of COVID-19 all present downside risks. At the same time, consumer and corporate spending booms present topside risks— which could possibly be followed by an inflationary episode. But our core case remains above-trend growth well into 2022, driving further upside to global stocks and, eventually, to global yields.