Are You Ready to File Your 2021 Federal Tax Return?

Posted on April 07, 2022

Planning and Guidance, Tailored To Your Life and Goals

News

Posted on October 24, 2021

Over recent months, we have seen a slowing of growth momentum and a renewed focus from some investors on potential tail risks. Despite a moderating pace of growth, we see a positive direction for the global economy and further upside for corporate earnings.

Central banks are past the point of maximum monetary policy accommodation, but even so, financial conditions remain extremely easy, with negative real rates set to persist for some time, providing a supportive backdrop for risk assets.

We favor a pro-risk tilt with an overweight to stocks spread across the U.S., Europe, and Japan, and with a modest cyclical tilt. Stock-bond correlation has returned to negative territory, so while we take a mild underweight to duration, we acknowledge its role as a portfolio diversifier.

Between Memorial Day in May and Labor Day in September — the traditional U.S. summer season — the S&P 500 made a record 28 all-time highs in 69 days of trading, delivering a price return of 7.9%. The upward grind of stocks in this most unusual of summers ran counter to the “Sell in May and go away” maxim: On average over the last 50 years, the S&P returned 1.7% between May and September, and 7.3% from September to the following May. A summer rally does have precedent, but the record number of new highs — against the backdrop of monetary policy uncertainties, Chinese regulatory change, and the ebb and flow of coronavirus statistics — certainly bears scrutiny.

We continue to expect above-trend growth through the end of 2022 and see further upside for equity earnings as economies around the globe reopen fully and pent-up demand materializes. But without a doubt, the momentum of growth is diminishing, and over the summer we saw economic surprise indices drop from elevated levels.

While moderating growth presents a headwind for stocks, not least by denting sentiment, a supportive backdrop remains in place: ample liquidity, strong household balance sheets, and a powerful capex cycle. Crucially, too, not all the rebound in equity earnings is yet reflected in analysts’ forecasts — providing a basis for further upside.

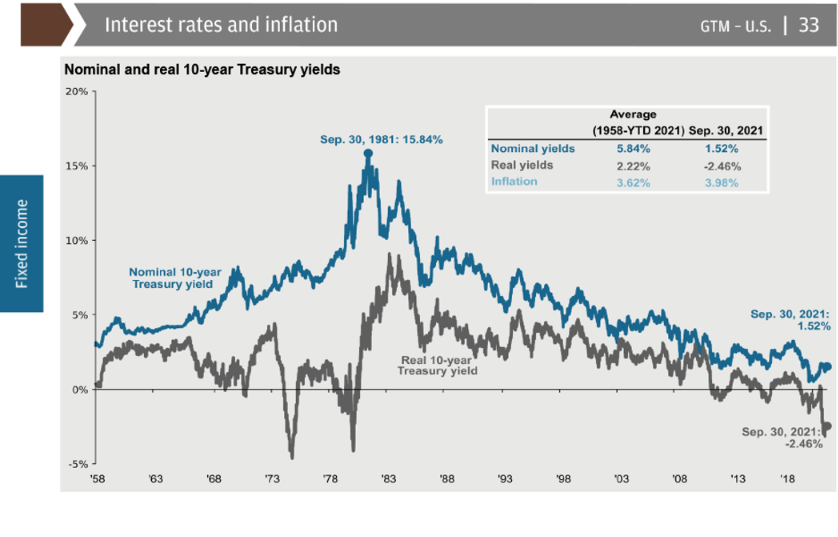

To be sure, there are some confusing signals across markets — not least from the bond market, which continues to appear detached from fundamental growth and inflation dynamics. But we would argue that this situation could persist for some time, given the ongoing central bank demand for duration, as well as other, less price-sensitive demand for bonds, such as by pension portfolios de-risking. Even accounting for a tapering of Federal Reserve (Fed) purchases starting later this year, we expect real yields to remain profoundly negative throughout 2022.

In the dog days of summer, we were certainly reminded that risks beyond COVID-19 continue. Regulatory tightening in China and, most recently, issues in China’s property sector have weighed on the wider emerging market (EM) complex. But even when they did, the U.S. and other developed equity markets remained reasonably poised. While some would argue a correction might be overdue, even in the event of a drawdown we would expect buyers to emerge quickly — noting, as we do, that the underlying combination of growth drivers and easy policy probably still outweigh the potential tail risk issues.

On the face of it, very little has changed in our preferred asset allocation from last quarter. However, below the surface, we continue to make subtle but important changes within portfolios. Notably, our attitude to duration has shifted. At the start of the year, we expected a rapid rise in yields and could take a pro-growth stance through an underweight in bonds. For a time, stock-bond correlations drifted into positive territory, in turn presenting a challenge to portfolio construction. As the sum of investors’ fears has shifted from inflation to growth, negative stock-bond correlation has reasserted itself, and despite low prevailing yields, bonds once again play a valuable role in portfolios, offsetting pro-risk positions taken in stocks.

While we continue to expect yields to rise from here and note that our models remain strongly negative on duration, we expect both the scale, and the pace of yield increases to be modest. For investors with a significant pro-risk stance in equities, the portfolio benefits of holding duration may now outweigh the mildly negative outlook that we have on bonds in isolation.

After substantial progress in reducing cases and fatalities in the spring, the pace of vaccinations has slowed, and the much more contagious Delta variant caused a recent resurgence of the pandemic. We now estimate between infection and inoculation, roughly 85% of the American people now have some immunity to COVID-19. This should allow cases and fatalities to fall in the months ahead. Further, while the pandemic isn’t over yet, many parts of the economy have adapted to operate in a pandemic environment. We hope the pandemic will fade as we move into 2022 but, whether it does or not, it should have much less of an impact in slowing the economy than it has over the last two years.

The federal government has hit a new record high debt-to-GDP ratio, levels that have not been seen since WWII. The $1.9 trillion American Rescue Plan is still working itself through the system and will continue to support the economy through the end of the year and into 2022. Further, negotiations continue in Washington on additional spending aimed at infrastructure, childcare, and education, among other initiatives. However, new stimulus would be stretched out over a decade and at least partially financed by tax increases, providing much less stimulus to the economy than we have seen over the last two years. In 2022, the economy should be much healthier than over the last two years, but it will also receive much less government support.

The road to pandemic recovery has been bumpier than expected, with the delta variant and severe supply shortages cutting into consumer and business spending. However, we expect growth to reaccelerate late this year as reopening resumes and companies try to rebuild inventories. As we move into 2022, the economy should have fully recovered from the pandemic.

Looking forward, a shortage of workers and less fiscal and monetary stimulus should slow economic growth to its long-term trend of roughly 2% by the end of next year.

With surging labor demand and a higher cost of low-wage labor due to enhanced unemployment benefits, employers have had to raise wages to attract workers. The below chart shows that as unemployment has fallen, wage growth has been rising and is above historical trends. While recent employment reports have disappointed expectations, rising wages and indicators of robust labor demand suggest slower job gains are primarily an issue of labor supply. This should keep wages elevated as the recovery continues, and is critically important for the Federal Reserve, as higher wages should feed through to higher inflation, implying that the economy could reach “maximum employment” sooner than past economic cycles may suggest.

Earnings have recovered spectacularly since the big declines in early 2020 and are now expected to hit a new all-time high in 2021. This reflects both stellar profits in sectors like technology and strong profits in health care throughout the pandemic, but also a rebound in many of the cyclical sectors that struggled the most last year. However, from 2022 on, slower economic growth, higher wage costs, higher interest rates and, potentially, higher corporate taxes could make further profit gains much more difficult to achieve.

Inflation signals have heated up significantly as a surge in consumer spending continues to collide with supply shortages across major sectors of the economy. Some drivers of much higher inflation are beginning to abate, and we expect inflation to moderate in 2022 as supply chain disruptions are ironed out and demand growth cools. However, strong wage growth, higher inflation expectations, a falling dollar, and the lagged effect of higher home prices on rents should keep inflation more elevated than at the end of the last expansion.

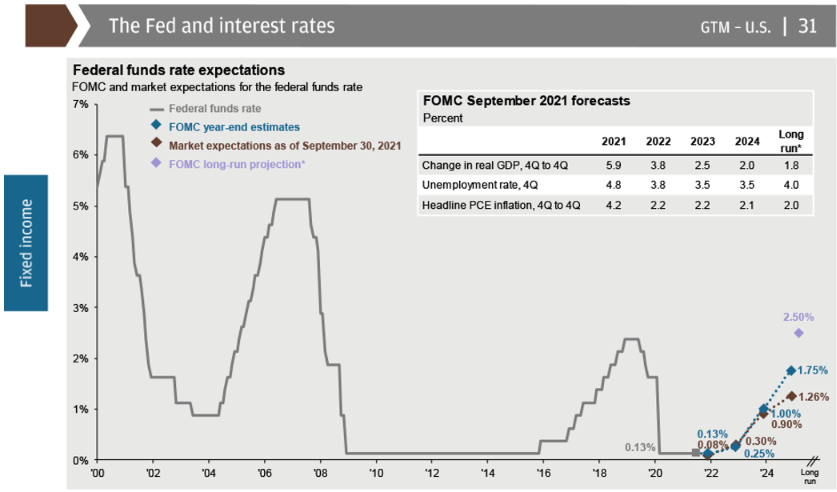

While Delta poses a risk, the economic recovery has been robust, and the Fed is keen to keep it on track. At its September meeting, the Federal Reserve gave markets an update on how it expects the broader economy to perform over the next few years. In general, the committee appears cautiously optimistic and still expects growth and inflation to run above historical trends but cool down as we move into next year. Also, with companies paying more to attract workers, job growth should remain solid. While this is mostly good news, the Fed still wants to keep interest rates low for as long as possible and may not begin raising rates until late 2022 or 2023. However, we continue to expect that they will begin to reduce bond purchases by year-end.

The combination of very easy monetary policy and a recession has left 10-year Treasury yields at very low levels. Interest rates will likely move higher into 2022, against the backdrop of rising inflation, faster growth, and a less accommodative Fed as they begin tapering. There continues to be a place in portfolios for fixed income to provide diversification and protection in the case of an equity market or economic relapse, but investors may want to focus on shorter duration bonds to be well-positioned if long-term rates resume their ascent.

U.S. equities have trended higher during the year, characterized by range-bound valuations and rising earnings expectations. Stock prices based on current forward P/E ratios still look elevated, although they have come in somewhat as earnings have played catch-up. Looking forward to 2022, returns will depend more heavily on profit margins. Rising wages, supply chain disruptions, and higher taxes could all negatively impact profit margins over the next few years. However, while elevated valuations may pose a speed limit for the market, the outlook for returns remains positive amidst strong fundamentals and corporate profitability.

After multiple years of strong outperformance of growth stocks, most notably during the pandemic in 2020, value has begun to recover. The next chart shows that even after a good start to 2021, value appears to remain cheap relative to growth compared to long-term averages. Additionally, value generally tends to outperform growth during periods of above-trend economic activity and rising interest rates.

However, investors would be wise not to abandon growth stocks altogether as the economy is likely to slow down to a much slower pace of economic growth later in 2022 and into 2023, and growth stocks have traditionally outperformed value stocks in a slow economic growth environment.

While the expected synchronized global recovery has been delayed, it has not been derailed, and vaccination progress overseas has gained speed with many countries now outpacing the U.S. We expect the global economy to continue to grow above trend over the next year and for robust earnings growth to be an important catalyst for international markets. In addition, valuations remain attractive with both emerging market and developed market stocks at some of their cheapest levels relative to the U.S. in the last 20 years. This, along with a global post-pandemic economic rebound, lower trade tensions, and the prospect of a lower dollar in the long run argue for a greater allocation to international equities, with a particular focus on East Asia and Europe.

This next chart shows S&P valuation dispersion over the last 25 years, illustrating a widening valuation gap between the most and least favored stocks in the index. The current S&P 500 valuation spread is markedly higher than the 25-year average – this wide dispersion in valuations points to an opportunity for active management.

The U.S. economy has had a bumpier recovery than expected but is still on strong footing as we enter the fourth quarter, and further progress on the pandemic at home and abroad will continue to be a tailwind for the global economic recovery. Given the substantial growth markets have had thus far in the economic cycle, investors would be wise to focus on fundamentals and maintain a somewhat diversified stance as we move forward to a, hopefully, much better 2022.

In sum, our portfolios maintain a pro-risk tilt, mainly through stocks. While we see the momentum of equity returns moderating, we do not expect a change in the direction over the coming months. The greatest risk to our portfolio stance today is a disappointment on growth — not an overshoot in inflation. But at the same time, we note that policymakers around the globe remain committed to supporting nominal growth, and this, in our view, provides a supportive backdrop for risk assets.

Source: J.P. Morgan Asset Management