“…sometime around 1985 the market really started to react to FOMC [Federal Open Market Committee] days. Like the Fed economists, we found that for the past 30 or so years these announcement days have had a major, and increasing, impact on the stock market…In fact, FOMC days account for 25 percent of the total real returns we have witnessed since 1984!”

Upon further examination, they realized the Fed’s influence on the Standard & Poor’s 500 Index (S&P 500) wasn’t caused by monetary policy decisions. Markets moved just because the committee was meeting. Investor sentiment was driving market action.

Last week, Federal Reserve Chair Janet Yellen commented, “It’s appropriate, and I’ve said this in the past, I think for the Fed to gradually and cautiously increase our overnight interest rate over time and probably in the coming months, such a move would be appropriate.” Her comments did not inspire ‘animal spirits,’ which is how economist John Maynard Keynes described the emotions that motivate people to act.

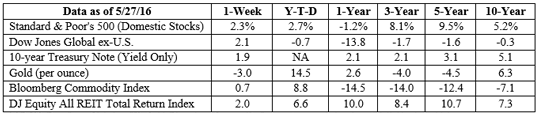

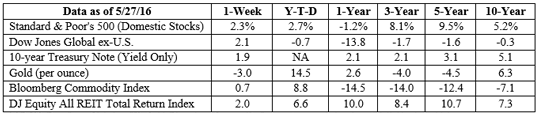

At the end of the week, the Dow Jones Industrial Average and the S&P 500 were higher on solid economic data that included an upward revision of first quarter’s gross domestic product (GDP) growth rate. GDP is the value of all goods and services produced in the United States during a given period.

The next FOMC meeting is June 14-15.

Chief Executive Officer Compensation Is Down. No, It’s Up.

You Better Judge For Yourself.

The New York Times reported the 200 most-highly-paid CEOs in the United States collectively experienced a pay cut last year! CEOs’ average compensation – all CEOs compensation added together and then divided by 200 – fell by 15 percent from 2014 to 2015.

Of course, you know what they say about lies and statistics.

Equilar, the company responsible for the study, reported CEO pay grew modestly in 2015. They looked at median CEO pay – the number in the middle. It was $16.6 million for fiscal 2015. That’s up 5 percent from the previous year.

No matter how you interpret the results, not one CEO earned more than $100 million. CEOs in the technology industry had the highest median pay while those in basic materials (which includes oil and gas companies) had the lowest, according to Equilar.

Many people have argued company performance should inform CEO pay, but there wasn’t much evidence this was the case. Although there may have been a basis for CEO pay changes, there was no clear correlation to shareholder returns or company revenues. For instance:

- A 702 percent increase in pay was awarded when total shareholder return was down 5 percent, and company revenues were down 1 percent.

- A 286 percent increase in pay was awarded when total shareholder return was up 16 percent, and company revenues were up 9 percent.

- A 48 percent reduction in pay occurred when total shareholder return was up 25 percent, and company revenues were up 4 percent.

The portion of 2015 corporate budgets allotted to pay hikes for employees increased by 2.8 percent, on average, according to Mercer. The report said, “…the highest-performing employees received average base pay increases of 4.8 percent in 2015 compared to 2.7 percent for average performers and 0.2 percent for the lowest performers…”

]]>

]]>

]]>