Market Insights:

January 2, 2024

Posted on January 02, 2024

Planning and Guidance, Tailored To Your Life and Goals

Tuesday Takeaway

Posted on June 21, 2016

“At this week’s confab, there were seven projections for two increases, to 0.875 percent, and six for a single hike, to 0.625 percent. There also were two outliers expecting more hikes to above 1 percent. Excluding the highest and lowest guesses, the “central tendency” was in a range of 0.6-0.9 percent, according to the Fed’s projections…In March, however, there was a solid consensus of nine members expecting two hikes to 0.875 percent, and seven looking for more hikes to over 1 percent. Back then, the single outlier was calling for just one increase to 0.625 percent.”

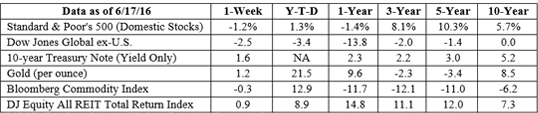

In the past, dovish Fed actions have pushed U.S. stock markets higher; however, stocks were lower by the end of the day on Wednesday, according to MarketWatch. Investor reticence may owe much to concerns about the possibility of a British exit. Experts cited by Barron’s suggested an EU exit may already be priced into markets since European bank stocks “have been crushed…with some down 40 percent and others at lows not seen in years.” Treasuries and high-quality government bonds rallied through the end of the week as investors opted for ‘safe haven’ investments*. On Friday, investors took profits after eight days of gains and rates pushed slightly higher, reported The Wall Street Journal. *US treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit and market risk. They are guaranteed by the US government as to the timely payment of principal and interest and, if help to maturity, offer a fixed rate of return and fixed principal value.

]]>

]]>