Market Insights:

January 2, 2024

Posted on January 02, 2024

Planning and Guidance, Tailored To Your Life and Goals

Tuesday Takeaway

Posted on May 06, 2019

The Markets

The Standard & Poor’s 500 Index is off to its best start in 20 years.

Despite the exceptional performance of U.S. stock markets year-to-date, and data that suggest economic growth remains steady, some analysts and investors have been pecking at Federal Reserve Chair Jerome Powell. They’re keen for the Fed to implement a rate cut, which could stimulate economic growth and help push stock markets higher, because inflation is lower than ideal, reported Howard Schneider and Ann Saphir of Reuters.

Recent data suggest core inflation is at 1.6 percent. That’s below the Fed’s target rate of 2 percent. Fed leaders have said they think low inflation may be temporary. Until a trend has been established to their satisfaction, they intend to do nothing. The Reuters article explained, “…preemptive…rate moves in either direction appear off the table for now, absent some unexpected event that raises new risks or shocks the economy into a higher or lower gear.”

Second-guessing the Fed is not new. In 1955, the ninth Chairman of the Federal Reserve, William McChesney Martin, offered this insight to the Fed’s work:

“Those who have the task of making [credit and monetary] policy don’t expect you to applaud. The Federal Reserve…is in the position of the chaperone who has ordered the punch bowl removed just when the party was really warming up.”

On Friday, jobs data suggested U.S. economic growth continues apace. The Bureau of Labor Statistics report showed unemployment was at a 49-year low. The news made investors happy, and the Nasdaq Composite and S&P 500 finished the week higher.

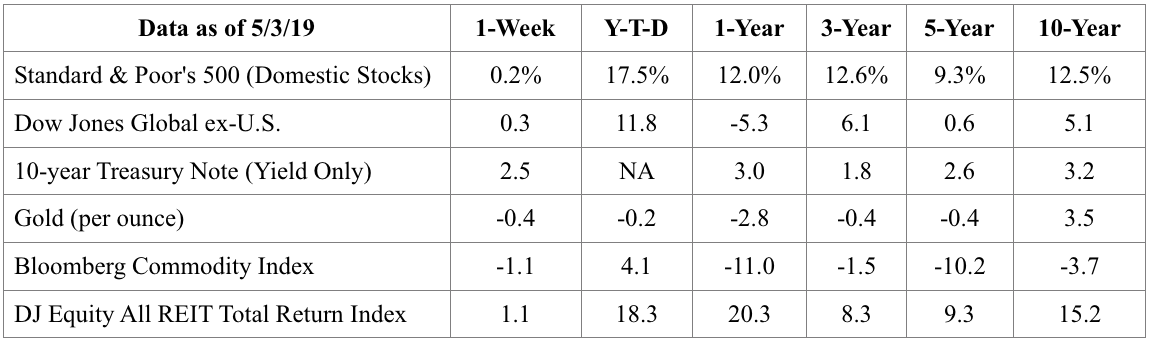

[caption id="attachment_2834" align="alignnone" width="1150"] S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.Last week, the Federal Reserve Open Market Committee statement indicated inflation was below target levels. The report stated, “On a 12-month basis, overall inflation and inflation for items other than food and energy have declined and are running below 2 percent.”

A less respected economic indicator is telling a similar story about inflation. The Tooth Fairy Index confirms the value of a baby tooth isn’t what it used to be. For the second consecutive year, the average monetary gift left behind by the Tooth Fairy was less generous. In 2018, it fell 43 cents to $3.70, on average.

There are regional differences. West Coast Tooth Fairies are, typically, more generous than Midwest tooth fairies. The regional numbers for 2018 looked like this:

The first baby tooth lost continues to command a higher value than other teeth. It was worth $4.96, on average, across the country.

The non-monetary benefits of impending Tooth Fairy visits can be significant. They may include: 1) early bedtime in anticipation of the visit; 2) joy when compensated for a lost tooth; 3) a chance to discuss the importance of oral hygiene; and 4) the opportunity to teach kids about saving.

“Joy, feeling one’s own value, being appreciated and loved by others, feeling useful and capable of production are all factors of enormous value for the human soul.”

–Maria Montessori, Italian physician and educator

]]>